(See related pages)

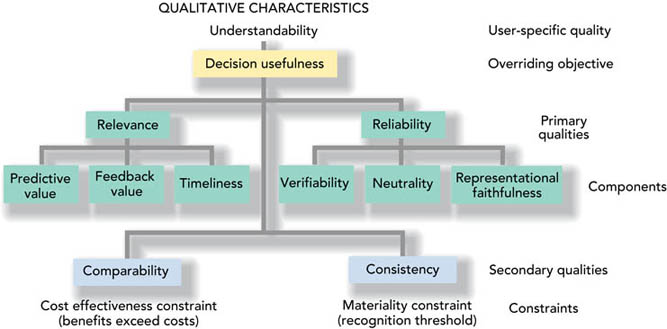

lLO6 To satisfy the stated objectives, information should possess certain characteristics. The purpose of SFAC 2 is to outline the desired qualitative characteristics of accounting information. Graphic 1-7 indicates these qualitative characteristics, presented in the form of a hierarchy of their perceived importance. Notice that the main focus, as stated in the first concept statement is on decision usefulnessthe quality of being useful to decision making.—the ability to be useful in decision making. Understandabilityusers must understand the information within the context of the decision being made. means that users must understand the information within the context of the decision being made. This is a user-specific quality because users will differ in their ability to comprehend any set of information. The first stated financial reporting objective of SFAC 1 is to provide comprehensible information to those who have a reasonable understanding of business and economic activities and are willing to study the information.

PRIMARY QUALITATIVE CHARACTERISTICSThe primary decision-specific qualities that make accounting information useful are relevanceone of the primary decision-specific qualities that make accounting information useful; made up of predictive value and/or feedback value, and timeliness. and reliabilitythe extent to which information is verifiable, representationally faithful, and neutral.. Both are critical. No matter how reliable, if information is not relevant to the decision at hand, it is useless. Conversely, relevant information is of little value if it cannot be relied on. Let’s look closer at each of these two characteristics, including the components that make those qualities desirable. We also consider two secondary qualities—comparability and consistency.

Relevance. To make a difference in the decision process, information must possess predictive valueconfirmation of investor expectations about future cash-generating ability. and/or feedback value.confirmation of investor expectations about future cash-generating ability. Generally, useful information will possess both qualities. For example, if net income and its components confirm investor expectations about future cash-generating ability, then net income has feedback value for investors. This confirmation can also be useful in predicting future cash-generating ability as expectations are revised. This predictive ability is central to the concept of “earnings quality,” the ability of reported earnings (income) to predict a company’s future earnings. This is a concept we revisit frequently throughout this textbook in order to explore the impact on earnings quality of various topics under discussion. For instance, in Chapter 4 we discuss the contents of the income statement and certain classifications used in the statement from the perspective of helping analysts separate a company’s transitory earnings from its permanent earnings. This separation is critical to a meaningful prediction of future earnings. In later chapters, we look at how various financial reporting decisions affect earnings quality. Timelinessinformation that is available to users early enough to allow its use in the decision process. also is an important component of relevance. Information is timely when it is available to users early enough to allow its use in the decision process. The need for timely information requires that companies provide information to external users on a periodic basis. The SEC requires its registrants to submit financial statement information not only on an annual basis, but also quarterly for the first three quarters of each fiscal year.

Reliability.Reliabilitythe extent to which information is verifiable, representationally faithful, and neutral. is the extent to which information is verifiable, representationally faithful, and neutral.Verifiabilityimplies a consensus among different measurers. implies a consensus among different measurers. For example, the historical cost of a piece of land to be reported in the balance sheet of a company is usually highly verifiable. The cost can be traced to an exchange transaction, the purchase of the land. However, the market value of that land is much more difficult to verify. Appraisers could differ in their assessment of market value. The term objectivity often is linked to verifiability. The historical cost of the land is objective but the land’s market value is subjective, influenced by the measurer’s past experience and prejudices. A measurement that is subjective is difficult to verify, which makes it more difficult for users to rely on. Representational faithfulnessagreement between a measure or description and the phenomenon it purports to represent. exists when there is agreement between a measure or description and the phenomenon it purports to represent. For example, assume that the term inventory in a balance sheet of a retail company is understood by external users to represent items that are intended for sale in the ordinary course of business. If inventory includes, say, machines used to produce inventory, then it lacks representational faithfulness.

Several years ago, accountants used the term reserve for doubtful accounts to describe anticipated bad debts related to accounts receivable. For many, the term reserve means that a sum of money has been set aside for future bad debts. Because this was not the case, this term lacked representational faithfulness. The description “reserve…” now has been changed to “allowance for uncollectible accounts” or “allowance for doubtful accounts.” In FedEx Corporation’s financial statements, the balance sheet in Appendix B reports Receivables, less allowances of $151 million and $149 million at the end of 2004 and 2003, respectively. FedEx Corporation Reliability assumes the information being relied on is neutral with respect to parties potentially affected. In that regard, neutralityneutral with respect to parties potentially affected. is highly related to the establishment of accounting standards. You learned earlier that changes in accounting standards can lead to adverse economic consequences to certain companies, their investors and creditors, and other interest groups. Accounting standards should be established with overall societal goals and specific objectives in mind and should try not to favor particular groups or companies.

The FASB faces a difficult task in balancing neutrality and the consideration of economic consequences. A new accounting standard may favor one group of companies over others, but the FASB must convince the financial community that this was a consequence of the standard and not an objective used to set the standard. Donald Kirk, one of the members of the first group to serve on the FASB, stressed the importance of neutrality in the standard-setting process. The qualities of relevance and reliability often clash. For example, a net income forecast provided by the management of a company may possess a high degree of relevance to investors and creditors trying to predict future cash flows. However, a forecast necessarily contains subjectivity in the estimation of future events. GAAP presently do not require companies to provide forecasts of any financial variables.

SECONDARY QUALITATIVE CHARACTERISTICSGraphic 1-7 identifies two secondary qualitative characteristics important to decision usefulness—comparability and consistency. Comparabilitythe ability to help users see similarities and differences among events and conditions. is the ability to help users see similarities and differences between events and conditions. We already have discussed the importance of the ability of investors and creditors to compare information across companies to make their resource allocation decisions. Closely related to comparability is the notion that consistencypermits valid comparisons between different periods. of accounting practices over time permits valid comparisons between different periods. The predictive and feedback value of information is enhanced if users can compare the performance of a company over time.29 In the FedEx financial statements in Appendix B, notice that disclosure Note 1 includes a summary of significant accounting policies. A change in one of these policies would require disclosure in the financial statements and notes to restore comparability between periods.

FedEx Corporation Brief-Exercises BE1-3, BE1-4, BE1-5, BE1-6 Exercises E1-5, E1-6, E1-7, E1-8, E1-9, E1-11, E1-12, E1-13, E1-14 Communication Case 1-5 Real World Case 1-13 28 Donald J. Kirk, chairman of the FASB, quoted in Status Report, December 23, 1986. 29 Companies occasionally do change their accounting practices, which makes it difficult for users to make comparisons among different reporting periods. Chapter 4 and Chapter 20 describe the disclosures that a company makes in this situation to restore consistency among periods. |