(See related pages)

lLO3

Accrual accounting is the financial reporting model used by the majority of profit-oriented companies and by many not-for-profit companies. The fact that companies use the same model is important to financial statement users. Investors and creditors use financial information to make their resource allocation decisions. It’s critical that they be able to compare financial information among companies. To facilitate these comparisons, financial accounting employs a body of standards known as generally accepted accounting principlesset of both broad and specific guidelines that companies should follow when measuring and reporting the information in their financial statements and related notes., of-ten abbreviated as GAAP (and pronounced gap). GAAP are a dynamic set of both broad and specific guidelines that companies should follow when measuring and reporting the information in their financial statements and related notes. The more important broad principles or standards are discussed in a subsequent section of this chapter and revisited throughout the text in the context of accounting applications for which they provide conceptual support.7 More specific standards, such as how to measure and report a lease transaction, receive more focused attention in subsequent chapters. HISTORICAL PERSPECTIVE AND STANDARDSPressures on the accounting profession to establish uniform accounting standards began to surface after the stock market crash of 1929. Some feel that insufficient and misleading financial statement information led to inflated stock prices and that this contributed to the stock market crash and the subsequent depression. The 1933 Securities Act and the 1934 Securities Exchange Act were designed to restore investor confidence. The 1933 act sets forth accounting and disclosure requirements for initial offerings of securities (stocks and bonds). The 1934 act applies to secondary market transactions and mandates reporting requirements for companies whose securities are publicly traded on either organized stock exchanges or in over-the-counter markets.8 The 1934 act also created the Securities and Exchange Commission (SEC)responsible for setting accounting and reporting standards for companies whose securities are publicly traded..

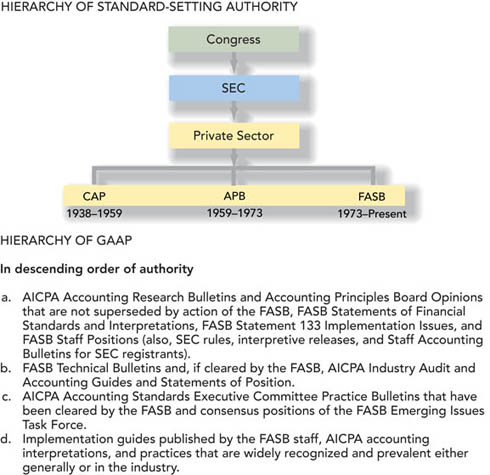

In the 1934 act, Congress gave the SEC both the power and responsibility for setting accounting and reporting standards for companies whose securities are publicly traded. However, the SEC, a government appointed body, has delegated the primary responsibility for setting accounting standards to the private sector. It is important to understand that the SEC delegated only the responsibility, not the authority, to set standards. The power still lies with the SEC. If the SEC does not agree with a particular standard issued by the private sector, it can force a change in the standard. In fact, it has done so in the past.

The SEC does issue its own accounting standards in the form of Financial Reporting Releases (FRRs), which regulate what must be reported by companies to the SEC itself. These standards usually agree with those previously issued by the private sector. To learn more about the SEC, consult its Internet site at www.sec.gov.9 Early Standard Setting. The first private sector body to assume the task of setting accounting standards was the Committee on Accounting Procedure (CAP)the first private sector body that was delegated the task of setting accounting standards.. The CAP was a committee of the American Institute of Accountants (AIA)national organization of professional public accountants.. The AIA, which was renamed the American Institute of Certified Public Accountants (AICPA)national organization of professional public accountants. in 1957, is the national organization of professional public accountants. From 1938 to 1959, the CAP issued 51 Accounting Research Bulletins (ARBs) which dealt with specific accounting and reporting problems. No theoretical framework for financial accounting was established. This approach of dealing with individual issues without a framework led to stern criticism of the accounting profession. In 1959 the Accounting Principles Board (APB)the second private sector body delegated the task of setting accounting standards. replaced the CAP. Members of the APB also belonged to the AICPA. The APB operated from 1959 through 1973 and issued 31 Accounting Principles Board Opinions (APBOs), various Interpretations, and four Statements. The Opinions also dealt with specific accounting and reporting problems. Many ARBs and APBOs have not been superseded and still represent authoritative GAAP.

The APB’s main effort to establish a theoretical framework for financial accounting and reporting was APB Statement No. 4, “Basic Concepts and Accounting Principles Underlying Financial Statements of Business Enterprises.” Unfortunately, the effort was not successful. The APB was composed of members of the accounting profession and was supported by their professional organization. Members participated in the activities of the board on a voluntary, part-time basis. The APB was criticized by industry and government for its inability to establish an underlying framework for financial accounting and reporting and for its inability to act quickly enough to keep up with financial reporting issues as they developed. Perhaps the most important flaw of the APB was a perceived lack of independence. Composed almost entirely of public accountants, the board was subject to the criticism that the clients of the represented public accounting firms were exerting self-interested pressure on the board and influencing their decisions. Other interest groups were underrepresented in the standard-setting process. Current Standard Setting. Criticism of the APB led to the creation in 1973 of the Financial Accounting Standards Board (FASB)the current private sector body that has been delegated the task of setting accounting standards. and its supporting structure. The FASB differs from its predecessor in many ways. There are seven full-time members of the FASB, compared to 18–21 part-time members of the APB. While all of the APB members belonged to the AICPA, FASB members represent various constituencies concerned with accounting standards. Members have included representatives from the accounting profession, profit-oriented companies, accounting educators, and government. The APB was supported financially by the AICPA, while the FASB is supported by its parent organization, the Financial Accounting Foundation (FAF).responsible for selecting the members of the FASB and its Advisory Council, ensuring adequate funding of FASB activities, and exercising general oversight of the FASB's activities. The FAF is responsible for selecting the members of the FASB and its Advisory Council, ensuring adequate funding of FASB activities, and exercising general oversight of the FASB’s activities.10 The FASB is, therefore, an independent, private sector body whose members represent a broad constituency of interest groups.11

In 1984, the FASB’s Emerging Issues Task Force (EITF)responsible for providing more timely responses to emerging financial reporting issues. was formed to provide more timely responses to emerging financial reporting issues. The EITF membership includes 15 individuals from public accounting and private industry, along with a representative from the FASB and an SEC observer. The membership of the task force is designed to include individuals who are in a position to be aware of emerging financial reporting issues. The task force considers these emerging issues and attempts to reach a consensus on how to account for them. If consensus can be reached, generally no FASB action is required. The task force disseminates its rulings in the form of EITF Issues. These pronouncements are considered part of generally accepted accounting principles.

If a consensus can’t be reached, FASB involvement may be necessary. The EITF plays an important role in the standard-setting process by identifying potential problem areas and then acting as a filter for the FASB. This speeds up the standard-setting process and allows the FASB to focus on pervasive long-term problems. One of the FASB’s most important activities has been the formulation of a conceptual frameworkdeals with theoretical and conceptual issues and provides an underlying structure for current and future accounting and reporting standards.. The conceptual framework project, discussed in more depth later in this chapter, deals with theoretical and conceptual issues and provides an underlying structure for current and future accounting and reporting standards. The FASB has issued seven Statements of Financial Accounting Concepts (SFACs) to describe its conceptual framework. The board also has issued over 150 specific accounting standards, called Statements of Financial Accounting Standards (SFASs), as well as numerous FASB Interpretations and Technical Bulletins.12

Graphic 1-2 summarizes this discussion on accounting standards. The top of the graphic shows the sources of accounting standards in order of authority. Congress gave the SEC the responsibility and authority to set accounting standards, specifically for companies whose securities are publicly traded. The SEC has delegated the task to various private sector bodies (currently the FASB) while retaining its legislated authority.

The lower portion of the graphic summarizes the framework for selecting the principles to be used in preparing financial statements in conformity with generally accepted accounting principles. The GAAP hierarchy includes the authoritative pronouncements and interpretations of the SEC, CAP, APB, and FASB, as well as AICPA industry guides, bulletins and interpretations. The FASB recently decided to categorize these various sources in descending order (a through d) of authority. Previously, this formalization of a hierarchy existed only in the auditing literature.13

THE ESTABLISHMENT OF ACCOUNTING STANDARDS—A POLITICAL PROCESSlLO4

The setting of accounting and reporting standards often has been characterized as a political process. Standards, particularly changes in standards, can have significant differential effects on companies, investors and creditors, and other interest groups. A change in an accounting standard or the introduction of a new standard can result in a substantial redistribution of wealth within our economy. The role of the FASB in setting accounting standards is a complex one. Sound accounting principles can provide significant guidance in determining the appropriate method to measure and report an economic transaction. However, the FASB must gauge the potential economic consequences of a change in a standard to the various interest groups as well as to society as a whole. One obvious desired consequence is that the new standard will provide a better set of information to external users and thus improve the resource allocation process.

An example of possible adverse economic consequences is the issue of accounting for postretirement employee health care benefits. Many corporations guarantee to pay the health care and life insurance costs of their employees after retirement. Traditionally, these companies accounted for these benefits as expenses in the period in which they made payments to or on behalf of retired employees. In 1989, the FASB proposed that these costs be accounted for by recognizing expenses over the period of employment rather than after retirement. Companies feared that the new standard would seriously depress their annual income, and as a result, they would be forced to reduce their health care costs for retirees to soften the effect of the new standard. A survey of 992 large companies found that during the two years following the adoption of the new standard, 79% of the companies surveyed changed their retiree medical plans. Of those, 78% increased retirees’ share of costs and 1% eliminated all coverage.14 As a specific example, American Telephone and Telegraph Co. in 1989 negotiated with its union to pay health care benefits to retirees only up to a maximum fixed amount, as opposed to unlimited medical benefits offered by many companies. Of course, AT&T’s decision to limit retiree medical benefits may have been purely a business decision unrelated to the new reporting requirements.15 Or, the new accounting standard may have caused companies like AT&T to reevaluate the costs and benefits of their postretirement packages. This issue is covered in depth in Chapter 17. Carl Landegger, chairman of The Black Clawson Company, expressed his fear of the new accounting standard in open hearings before the FASB in 1989. The FASB reacted to these fears by modifying their originally proposed accounting treatment to ease possible adverse economic consequences to current and future retirees covered by these postretirement health care plans. The resulting standard, SFAS 106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions,” was issued in 1990. Another example of the effect of economic consequences on standard setting is the highly controversial debate surrounding accounting for employee stock options. Employees often are given the option to buy shares in the future at a preset price as an integral part of their total compensation package. The accounting objective for any form of compensation is to report compensation expense during the period of service for which the compensation is given. At issue is the amount of compensation to be recognized as expense for stock options.

Historically, options have been measured at their intrinsic value, which is the simple difference between the market price of the shares and the option price at which they can be acquired. For instance, an option that permits an employee to buy $60 stock for $42 has an intrinsic value of $18. The problem is that options for which the exercise price equals the market value of the underlying stock at the date of grant (which describes most plans) have no intrinsic value and thus result in zero compensation when measured this way, even though the fair value of the options can be quite substantial. To the FASB and many others, it seems counterintuitive to not record any compensation expense for arrangements that routinely provide a large part of the total compensation of executives. In 1995, after lengthy debate, the FASB bowed to public pressure and consented to encourage, rather than require, companies to expense the fair value of employee stock options. Recently, nearly a decade later, the contentious issue resurfaced, and the FASB issued an exposure draft requiring companies to measure options at their fair values and to expense that amount over an appropriate service period. This issue is discussed at greater length in Chapter 19.

The most recent example of the political process at work in standard setting is the heated debate that occurred on the issue of accounting for business combinations. Back in 1996, the FASB added to its agenda a project to consider a possible revision in the practice of allowing two separate and distinct methods of accounting for business combinations, the pooling of interests method and the purchase method. A thorough explanation of the differences between these methods is beyond the scope of this text. For our discussion here, just note that a key issue in the debate related to goodwill, an intangible asset that arises only in business combinations accounted for using the purchase method. Under the then-existing standards, goodwill, like any other intangible asset, was amortized (expensed) over its estimated useful life thus reducing reported net income for several years following the acquisition. It was that negative impact on earnings that motivated many companies involved in a business combination to take whatever steps necessary to structure the transaction as a pooling of interests, thereby avoiding goodwill, its amortization to expense, and the resulting reduction in earnings. As you might guess, when the FASB initially proposed eliminating the pooling method, many companies that were actively engaged in business acquisitions vigorously opposed the elimination of this means of avoiding goodwill. To support their opposition these companies argued that if they were required to use purchase accounting, many business combinations important to economic growth would prove unattractive due to the negative impact on earnings caused by goodwill amortization and would not be undertaken.

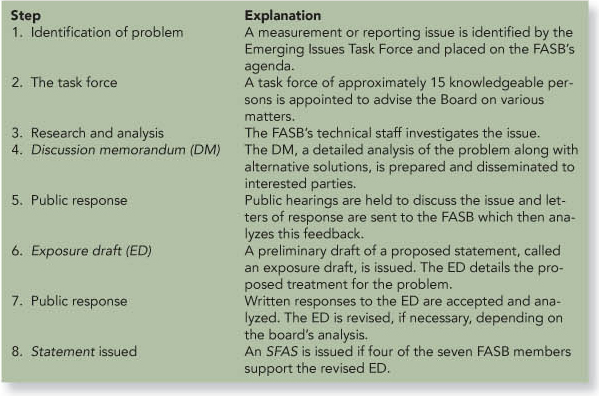

To satisfy opposition to its proposal, the FASB suggested several modifications over the years, but it wasn’t until the year 2000 that a satisfactory compromise was reached. Specifically, under the new accounting standards issued in 200118, only the purchase method is acceptable, but to soften the impact, the resulting goodwill is not amortized. We discuss goodwill and its measurement in Chapters 10 and 11. The FASB’s dilemma is to balance accounting considerations and political considerations resulting from perceived possible adverse economic consequences. To help solve this dilemma, the board undertakes a series of elaborate information-gathering steps before issuing a substantive accounting standard involving alternative accounting treatments for an economic transaction. These steps include open hearings, deliberations, and requests for written comments from interested parties. For example, 467 comment letters were received on the 1989 proposal concerning accounting for postretirement employee health care benefits. Graphic 1-3 outlines the FASB’s standard-setting process.

These steps are the FASB’s attempt to acquire consensus as to the preferred method of accounting, as well as to anticipate adverse economic consequences. The board’s process is similar to that of an elected political representative, a U.S. congresswoman for example, trying to determine consensus among her constituency before voting on a bill on the floor of the House of Representatives. For this reason, accounting standard setting is a political process. OUR GLOBAL MARKETPLACEAdvances in communication and transportation systems continue to expand the marketplace in which companies operate. The world economy is more integrated than ever, and many of the larger U.S. corporations are truly multinational in nature. These multinational corporations have their home in the United States but operate and perhaps raise capital in other countries. For example, Coca-Cola, IBM, Colgate-Palmolive, Gillette, and many other companies generate more than 50% of their revenue from foreign sales. It is not uncommon for even relatively small companies to transact business in many different countries.

Of course, many foreign corporations operate in the United States as well. In fact, companies such as Columbia Records and Bridgestone Americas Holding are owned by companies that reside in other countries. The financial marketplace also has taken on a global dimension, with many companies crossing geographic boundaries to raise capital. For example, nearly 500 foreign companies are listed on the New York Stock Exchange and nearly 400 foreign companies are listed on the London Stock Exchange. This expanded marketplace requires that company management understand the laws, customs, regulations, and accounting and reporting standards of many different countries. Toward Global Accounting Standards. Most industrialized countries have organizations responsible for determining accounting and reporting standards. In some countries, the United Kingdom for instance, the responsible organization is a private sector body similar to the FASB in the United States. In other countries, such as France, the organization is a governmental body. Accounting standards prescribed by these various groups are not the same. Standards differ from country to country for many reasons, including different legal systems, levels of inflation, culture, degrees of sophistication and use of capital markets, and political and economic ties with other countries. These differences can cause problems for multinational corporations. A company doing business in more than one country may find it difficult to comply with more than one set of accounting standards if there are important differences among the sets. It has been argued that different national accounting standards impair the ability of companies to raise capital in international markets. In response to this problem, the International Accounting Standards Committee (IASC)umbrella organization formed to develop global accounting standards. was formed in 1973 to develop global accounting standards. The IASC in 2001 reorganized itself and created a new standard-setting body called the International Accounting Standards Board (IASB)objectives are to develop a single set of high-quality, understandable global accounting standards, to promote the use of those standards, and to bring about the convergence of national accounting standards and International Accounting Standards.. The IASC now acts as an umbrella organization similar to the Financial Accounting Foundation (FAF) in the United States. This new global standard-setting structure is consistent with a recent FASB vision report attempting to identify an optimal standard-setting environment.19 The IASB’s objectives are (1) to develop a single set of high quality, understandable global accounting standards, (2) to promote the use of those standards, and (3) to bring about the convergence of national accounting standards and international accounting standards.

The IASC issued 41 International Accounting Standards (IASs). The IASB endorsed these standards when it was formed in 2001. Since then, the IASB has revised many of them and has issued six standards of its own, called International Financial Reporting Standards (IFRSs)voluntary IASB standards.. Compliance with these standards is voluntary, since the IASB has no authority to enforce them. However, more and more countries are basing their national accounting standards on international accounting standards.20 The International Organisation of Securities Commissions (IOSCO) approved a resolution permitting its members to use these standards to prepare their financial statements for cross-border offerings and listings. Beginning in 2005, all listed companies in the European Union (EU) must prepare their consolidated financial statements using IFRS. Some 7,000 listed EU companies are affected.

In the United States, the move toward convergence of accounting standards began in earnest with the cooperation of the FASB and the IASC on the earnings per share (EPS) issue. In 1994, the FASB and the IASC began working on projects leading toward the issuance of new standards for the computation of EPS. The intent of the FASB’s project was to issue an EPS standard that would be compatible with the new international standard and, at the same time, simplify U.S. GAAP. Chapter 19 describes this standard. In 2002, the FASB and IASB signed the so-called Norwalk Agreement, formalizing their commitment to convergence of U.S. GAAP and IFRS. Under this agreement, the boards pledged to remove existing differences between their standards and to coordinate their future standard-setting agendas so that major issues are worked on together. Recent standards issued by the FASB that you will encounter in our later discussions on share-based compensation, nonmonetary exchanges, and inventory costs are recent examples of this commitment to convergence.

Global Perspectives are included throughout the text to emphasize that our economy does not operate in isolation and to introduce you to some of the differences and similarities in accounting and reporting practices around the world. In addition, your instructor may assign end-of-chapter international cases to further explore these differences and similarities. THE ROLE OF THE AUDITOR

FedEx Corporation It is the responsibility of management to apply accounting standards when communicating with investors and creditors through financial statements. Another group, auditorsindependent intermediaries who help ensure that management has appropriately applied GAAP in preparing the company's financial statements., serves as an independent intermediary to help ensure that management has in fact appropriately applied GAAP in preparing the company’s financial statements. Auditors examine (audit) financial statements to express a professional, independent opinion. The opinion reflects the auditors’ assessment of the statements’ “fairness,” which is determined by the extent to which they are prepared in compliance with GAAP. The report of the independent auditors for FedEx Corporation’s financial statements is in Appendix B. The first two paragraphs explain the scope of the audit, and the third states the auditors’ opinion. After conducting its audit, the accounting firm Ernst & Young LLP stated that “In our opinion, the financial statements referred to above present fairly, …, in conformity with U.S. generally accepted accounting principles.” This is known as a clean opinion. If there had been any material departures from GAAP or other problems that caused the auditors to question the fairness of the statements, the report would have been modified to inform readers. The auditor adds credibility to the financial statements, increasing the confidence of capital market participants who rely on the information. Auditors, therefore, play an important role in the resource allocation process.

In most states, only individuals licensed as certified public accountants (CPAs)national organization of professional public accountants. in the state can represent that the financial statements have been audited in accordance with generally accepted auditing standards. Requirements to be licensed as a CPA vary from state to state, but all states specify education, testing, and experience requirements. The testing requirement is to pass the Uniform CPA Examination.

FINANCIAL REPORTING REFORMThe dramatic collapse of Enron in 2001 and the dismantling of the international public accounting firm of Arthur Andersen in 2002 severely shook U.S. capital markets. The credibility of the accounting profession itself as well as of corporate America was called into question. Public outrage over accounting scandals at high-profile companies like WorldCom, Xerox, Merck, Adelphia Communications, and others increased the pressure on lawmakers to pass measures that would restore credibility and investor confidence in the financial reporting process. Sarbanes-Oxley

Driven by these pressures, Congress acted swiftly and passed the Public Company Accounting Reform and Investor Protection ACT of 2002, commonly referred to as the Sarbanes-Oxley Act for the two congressmen who sponsored the bill. The legislation is comprehensive in its inclusion of the key players in the financial reporting process. The law provides for the regulation of auditors and the types of services they furnish to clients, increases accountability of corporate executives, addresses conflicts of interest for securities analysts, and provides for stiff criminal penalties for violators. Graphic 1-4 outlines the key provisions of the Act.

The changes imposed by the legislation are dramatic in scope and pose a significant challenge for the public accounting profession. At the same time, many maintain the changes were necessary to lessen the likelihood of corporate and accounting fraud and to restore investor confidence in the U.S. capital markets.

Section 404 is perhaps the most controversial provision of the 2002 act. No one argues the importance of adequate internal controls. However, the costs of implementing this section of the act can be substantial. Not only are companies required to document internal controls and assess their adequacy, but their auditors, too, must provide an opinion on management’s assessment. The Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 2 added an additional requirement that auditors express a second opinion on whether the company has maintained effective internal control over financial reporting.22 We revisit Section 404 in Chapter 7 in the context of an introduction to internal controls.

A MOVE AWAY FROM RULES-BASED STANDARDS?The accounting scandals at Enron and other companies also rekindled the debate over principles-basedapproach to standard setting stresses professional judgment, as opposed to following a list of rules., or more recently termed objectives-orientedapproach to standard setting stresses professional judgment, as opposed to following a list of rules., versus rules-baseda list of rules for choosing the appropriate accounting treatment for a transaction. accounting standards. In fact, a provision of the Sarbanes-Oxley Act required the SEC to study the issue and provide a report to Congress on its findings. That report, issued in July 2003, recommended that accounting standards be developed using an objectives-oriented approach.23 The FASB also issued a proposal addressing this issue.24

An objectives-oriented approach to standard setting stresses using professional judgment, as opposed to following a list of rules when choosing the appropriate accounting treatment for a transaction. Lease accounting provides a useful example for comparing the two approaches. In Chapter 15 you will learn that a company records a long-term lease of an asset as either a capital lease or an operating lease. If a leasing arrangement is “in substance” the purchase of an asset with the lease payments effectively serving as payments for that purchase, we should account for the transaction that way. A capital lease requires that the property being leased be recorded as an asset and a liability to pay for the asset. No asset or liability is recorded for an operating lease. Therein lies the problem. Because company managers are aware that analysts view debt as indicative of financial risk, those managers often try to avoid reporting more debt than absolutely necessary. As a result, firms frequently stretch the limits of the rules to structure lease agreements so that they technically sidestep the FASB’s detailed rules, principally four criteria provided in SFAS No. 13, for identifying capital leases that require recording a liability. In contrast, the IASB employs an objectives-oriented approach to lease accounting in its IAS 17. In that standard, the focus is on professional judgment rather than specific rules to determine whether the leasing arrangement effectively transfers the “risk and rewards” of ownership. Professional judgment is then applied to determine if the risk and rewards have been transferred. Which approach is more likely to capture the economic substance of the lease, rather than its form? The FASB’s criteria were designed to aid the accountant in determining whether the risk and rewards of ownership have been transferred. Many would argue, though, that the result has been the opposite. Rather than use the criteria to enhance judgment, management and its accountants can use the rules as an excuse to avoid using professional judgment altogether and instead focus on the rules alone. Proponents of an objectives-oriented approach argue that its focus is squarely on professional judgment, there are few rules to sidestep, and we more likely will arrive at an appropriate accounting treatment. Detractors, on the other hand, argue that the absence of detailed rules opens the door to even more abuse. Even in the absence of intentional misuse, reliance on professional judgment could result in different interpretations for similar transactions, raising concerns about comparability. The FASB is actively considering whether to move toward objectives-oriented standard setting. That the IASB primarily follows an objectives-oriented approach, coupled with the FASB’s recent moves toward convergence of U.S. and international standards, hints at a leaning in that direction. Opposition, though, is ardent. The debate has by no means ended. Brief-Exercises BE1-2 Communication Case 1-6 Ethics Case 1-7 7 The terms standards and principles sometimes are used interchangeably. 8 Reporting requirements for SEC registrants include Form 10-K, the annual report form, and Form 10-Q, the report that must be filed for the first three quarters of each fiscal year. 9 In 2000, the SEC issued regulation FD (Fair Disclosure) which redefined how companies interact with analysts and the public in disclosing material information. Prior to regulation FD, companies often disclosed important information to a select group of analysts before disseminating the information to the general public. Now, this type of selective disclosure is prohibited. The initial disclosure of market-sensitive information must be made available to the general public. 10 The FAF’s primary sources of funding are contributions and the sales of the FASB’s publications. The FAF is governed by trustees, the majority of whom are appointed from the membership of eight sponsoring organizations. These organizations represent important constituencies involved with the financial reporting process. For example, one of the founding organizations is the Association of Investment Management and Research (formerly known as the Financial Analysts Federation) which represents financial information users, and another is the Financial Executives International which represents financial information preparers. The FAF also raises funds to support the activities of the Government Accounting Standards Board (GASB). 11 The FASB organization also includes the Financial Accounting Standards Advisory Council (FASAC). The major responsibility of the FASAC is to advise the FASB on the priorities of its projects, including the suitability of new projects that might be added to its agenda. 12 For more information, go to the FASB’s Internet site at www.fasb.org. 13 The hierarchy presented here is based on an Exposure Draft entitled “The Hierarchy of Generally Accepted Accounting Principles,”Proposed Statement of Financial Accounting Standards, (Norwalk, Conn.: FASB), April 28, 2005. The Standard was expected to be effective for fiscal periods beginning after September 15, 2005. The FASB’s Concept Statements are not included in the hierarchy. They do not constitute GAAP, but provide a structure for evaluating current standards and for issuing new standards. 14 Rod Coddington, “USA Snapshots,” Hewitt Associates Survey of 992 Large Employers, USA Today (November 8, 1991). 15 A change in an accounting standard does not directly affect the cash flow of a company. For example, changing from the cash to the accrual method of accounting for postretirement health care benefits does not directly change the amounts and timing of the cash payments the company has to make to retirees. However, real cash flow effects could result for a number of reasons. As a result of the change in a standard, (1) a company could alter the way it operates, (2) income tax payments could change, or (3) the new standard could cause the violation of a debt agreement thus increasing financing costs. 16 Carl Landegger, reprinted in Accounting Today (October 23, 1989), p. 1. 17 Jonathan Weil, “FASB Backs Down on Goodwill-Accounting Rules,” The Wall Street Journal (December 7, 2000). 18 "Business Combinations," Statement of Financial Accounting Standards No. 141 (Norwalk, Conn.: FASB, 2001), and “Goodwill and Other Intangible Assets,” Statement of Financial Accounting Standards No. 142 (Norwalk, Conn.: FASB, 2001). 19International Accounting Standard Setting: A Vision for the Future (Norwalk, Conn.: FASB, 1998). 20 Helen Gernon and Gary Meek, Accounting: An International Perspective (New York: The McGraw-Hill Companies, 2001). 21 James Kuhnhenn, “Bush Vows to Punish Corporate Lawbreakers,” San Jose Mercury News (July 9, 2002), p. 8A. 22 "An Audit of Internal Control over Financial Reporting Performed in Conjunction with an Audit of Financial Statements," Auditing Standard No. 2 (Washington, D.C.: PCAOB, 2004). 23 “Study Pursuant to Section 108 (d) of the Sarbanes-Oxley Act of 2002 on the Adoption by the United States Financial Reporting System of a Principles-Based Accounting System,” Securities and Exchange Commission (July 2003). 24 “Principles-Based Approach to U.S. Standard Setting,” A Financial Accounting Standards Board Proposal (Norwalk, Conn.: FASB, 2002). | ||||||||||||||||||||||||||||||||||||||||