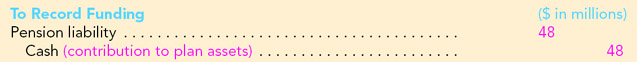

When Global adds its annual cash investment to its plan assets, the value of those plan assets increases by $48 million. Since the pension liability is the excess of the PBO over plan assets, that liability is reduced when plan assets increase:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/340185/pg_847_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/340185/pg_847_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a>

| PBO | | 48↑ | Less: plan assets | | 48↓ | Pension liability |

|

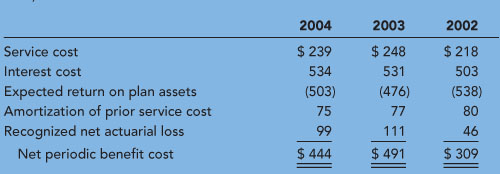

It is not unusual for the cash contribution to differ from that year’s pension expense. After all, the determination of the periodic pension expense and the funding of the pension plan are two separate processes. Pension expense is an accounting decision. How much to contribute each year is a financing decision affected by cash flow and tax considerations, as well as minimum funding requirements of ERISA. Subject to these considerations, cash contributions are actuarially determined with the objective of accumulating (along with investment returns) sufficient funds to provide promised retirement benefits. The pension expense is, of course, reported in the income statement. In addition, the composition of that amount must be reported in disclosure notes. For instance, Northwest Air Lines described the composition of its pension expense in the disclosure note in its 2004 annual report, shown in Graphic 17-10. GRAPHIC 17-10

Disclosure of Pension Expense—Northwest Air Lines

| Note 12: Pension and Other Postretirement Health Care Benefits The components of net periodic cost of defined benefit plans included the following (in millions):  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_1360.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_1360.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

| The components of pension expense are itemized in the disclosure note. |

|