1. Cite three examples of recent decisions that you made in which you, at least implicitly, weighed marginal cost and marginal benefit. 2. Indicate whether each of the following statements applies to microeconomics or macroeconomics: - The unemployment rate in the United States was 5.2 percent in January 2005.

- A U.S. software firm discharged 15 workers last month and transferred the work to India.

- An unexpected freeze in central Florida reduced the citrus crop and caused the price of oranges to rise.

- U.S. output, adjusted for inflation, grew by 3.5 percent in 2005.

- Last week Wells Fargo Bank lowered its interest rate on business loans by one-half of 1 percentage point.

- The consumer price index rose by 3.4 percent in 2005.

3. Suppose you won $15 on a lotto ticket at the local 7-Eleven and decided to spend all the winnings on candy bars and bags of peanuts. The price of candy bars is $.75 and the price of peanuts is $1.50. - Construct a table showing the alternative combinations of the two products that are available.

- Plot the data in your table as a budget line in a graph. What is the slope of the budget line? What is the opportunity cost of one more candy bar? Of one more bag of peanuts? Do these opportunity costs rise, fall, or remain constant as each additional unit of the product is purchased?

- How, in general, would you decide which of the available combinations of candy bars and bags of peanuts to buy?

- Suppose that you had won $30 on your ticket, not $15. Show the $30 budget line in your diagram. Why would this budget line be preferable to the old one?

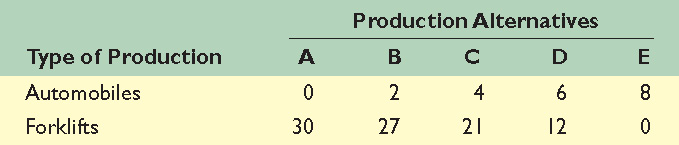

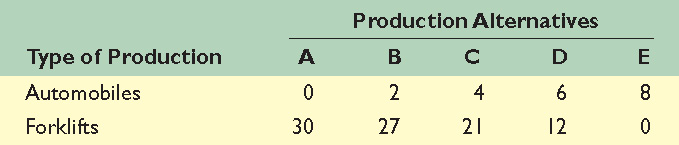

4. Below is a production possibilities table for consumer goods (automobiles) and capital goods (forklifts):  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384253/KeyQuestion_Ch01_Graph01.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384253/KeyQuestion_Ch01_Graph01.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>- Show these data graphically. Upon what specific assumptions is this production possibilities curve based?

- If the economy is at point C , what is the cost of one more automobile? Of one more forklift? Explain how the production possibilities curve reflects the law of increasing opportunity costs.

- If the economy characterized by this production possibilities table and curve were producing 3 automobiles and 20 fork lifts, what could you conclude about its use of its available resources?

- What would production at a point outside the production possibilities curve indicate? What must occur before the economy can attain such a level of production?

5. Specify and explain the typical shapes of marginal-benefit and marginal-cost curves. How are these curves used to determine the optimal allocation of resources to a particular product? If current output is such that marginal cost exceeds marginal benefit, should more or fewer resources be allocated to this product? Explain. 6. Referring to the table in question 10, suppose improvement occurs in the technology of producing forklifts but not in the technology of producing automobiles. Draw the new production possibilities curve. Now assume that a technological advance occurs in producing automobiles but not in producing forklifts. Draw the new production possibilities curve. Now draw a production possibilities curve that reflects technological improvement in the production of both goods. 7. On average, households in China save 40 percent of their annual income each year, whereas households in the United States save less than 5 percent. Production possibilities are growing at roughly 9 percent annually in China and 3.5 percent in the United States. Use graphical analysis of "present goods" versus "future goods" to explain the differences in growth rates. |