| Available with McGraw-Hill's Homework Manager |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/HM_icon.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/HM_icon.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> |

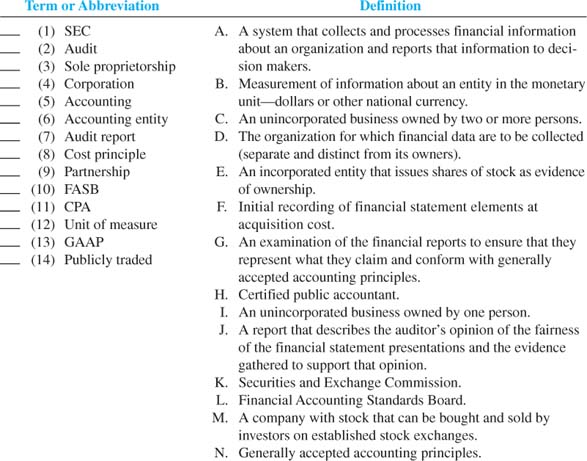

Match each definition with its related term or abbreviation by entering the appropriate letter in the space provided.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg32_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg32_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-1 Matching Definitions with Terms or Abbreviations

LO1, 2 | According to its annual report, “P&G's more than 250 brands include Pampers, Tide, Ariel, Always, Whisper, Pantene, Bounty, Pringles, Folgers, Charmin, Downy, Lenor, Iams, Olay, Crest, Vicks and Actonel.” The following are items taken from its recent balance sheet and income statement. Note that different companies use slightly different titles for the same item. Mark each item in the following list as an asset (A), liability (L), or stockholders' equity (SE) that would appear on the balance sheet or a revenue (R) or expense (E) that would appear on the income statement. ______ (1) Accounts receivable ______ (2) Cash and cash equivalents ______ (3) Net sales ______ (4) Notes payable ______ (5) Taxes payable ______ (6) Retained earnings ______ (7) Cost of products sold ______ (8) Marketing, administrative, and other operating expenses ______ (9) Income taxes ______ (10) Accounts payable ______ (11) Land ______ (12) Property, plant, and equipment ______ (13) Long-term debt ______ (14) Inventories ______ (15) Interest expense

| E1-2 Matching Financial Statement Items to Financial Statement Categories

LO1

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pglogo_lg.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pglogo_lg.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Tootsie Roll Industries is engaged in the manufacture and sale of candy. Major products include Tootsie Roll, Tootsie Roll Pops, Tootsie Pop Drops, Tootsie Flavor Rolls, Charms, and Blow-Pop lollipops. The following items were listed on Tootsie Roll's recent income statement and balance sheet. Mark each item from the balance sheet as an asset (A), liability (L), or shareholders' equity (SE) and each item from the income statement as a revenue (R) or expense (E). ______ (1) Notes payable to banks ______ (2) General and administrative ______ (3) Accounts payable ______ (4) Dividends payable ______ (5) Retained earnings ______ (6) Cash and cash equivalents ______ (7) Accounts receivable ______ (8) Provision for income taxes* ______ (9) Cost of goods sold ______ (10) Machinery and equipment ______ (11) Net sales ______ (12) Inventories ______ (13) Marketing, selling, and advertising ______ (14) Buildings ______ (15) Land ______ (16) Income taxes payable ______ (17) Distribution and warehousing costs ______ (18) Investments (in other companies)

| E1-3 Matching Financial Statement Items to Financial Statement Categories

LO1

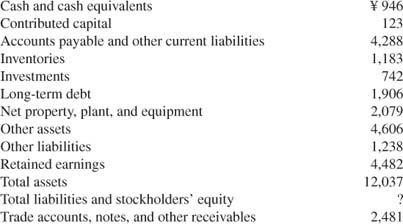

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/hdr_logo.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/hdr_logo.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Honda Motor Corporation of Japan is a leading international manufacturer of automobiles, motorcycles, all-terrain vehicles, and personal watercraft. As a Japanese company, it follows Japanese GAAP and reports its financial statements in billions of yen (the sign for yen is ¥). Its recent balance sheet contained the following items (in billions). Prepare a balance sheet as of March 31, 2007, solving for the missing amount. (Hint: Exhibit 1.2 in the chapter provides a good model for completing this exercise.)  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg33_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg33_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-4 Preparing a Balance Sheet

LO1

Honda motor co.

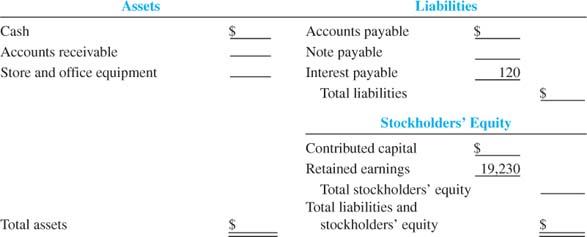

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/international.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/international.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Terry Lloyd and Joan Lopez organized Read More Store as a corporation; each contributed $75,000 cash to start the business and received 4,000 shares of common stock. The store completed its first year of operations on December 31, 2010. On that date, the following financial items for the year were determined: December 31, 2010, cash on hand and in the bank, $73,350; December 31, 2010, amounts due from customers from sales of books, $39,000; unused portion of store and office equipment, $72,000; December 31, 2010, amounts owed to publishers for books purchased, $12,000; one-year note payable to a local bank for $3,000. No dividends were declared or paid to the stockholders during the year. Required: Complete the following balance sheet as of the end of 2010. What was the amount of net income for the year? (Hint: Use the retained earnings equation [Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings] to solve for net income.) ______ ______ ______

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg34_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg34_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-5 Completing a Balance Sheet and Inferring Net Income

LO1 | Assume that you are the owner of The University Shop, which specializes in items that interest students. At the end of January 2010, you find (for January only) this information: Sales, per the cash register tapes, of $110,000, plus one sale on credit (a special situation) of $3,000. With the help of a friend (who majored in accounting), you determined that all of the goods sold during January had cost $40,000 to purchase. During the month, according to the checkbook, you paid $37,000 for salaries, rent, supplies, advertising, and other expenses; however, you have not yet paid the $900 monthly utilities for January on the store and fixtures.

Required: On the basis of the data given (disregard income taxes), what was the amount of net income for January? Show computations. (Hint: A convenient form to use has the following major side captions: Revenue from Sales, Expenses, and the difference—Net Income.) | E1-6 Analyzing Revenues and Expenses and Preparing an Income Statement

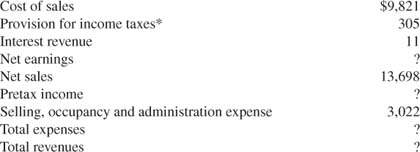

LO1 | Walgreen Co. is the nation's leading drugstore chain. Its recent quarterly income statement contained the following items (in millions). Solve for the missing amounts and prepare an income statement for the quarter ended May 31, 2007. (Hint: First order the items as they would appear on the income statement and then solve for the missing values. Exhibit 1.3 in the chapter provides a good model for completing this exercise.)  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg34_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg34_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-7 Preparing an Income Statement and Inferring Missing Values

LO1

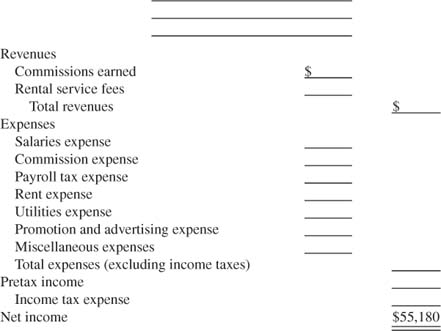

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/613711/WalgreensLogotype_red.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/613711/WalgreensLogotype_red.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> | Home Realty, Incorporated, has been operating for three years and is owned by three investors. J. Doe owns 60 percent of the total outstanding stock of 9,000 shares and is the managing executive in charge. On December 31, 2012, the following financial items for the entire year were determined: commissions earned and collected in cash, $150,900, plus $16,800 uncollected; rental service fees earned and collected, $20,000; salaries expense paid, $62,740; commissions expense paid, $35,330; payroll taxes paid, $2,500; rent paid, $2,475 (not including December rent yet to be paid); utilities expense paid, $1,600; promotion and advertising paid, $7,750; income taxes paid, $19,400; and miscellaneous expenses paid, $500. There were no other unpaid expenses at December 31. Also during the year, the company paid the owners “out-of-profit” cash dividends amounting to $12,000. Complete the following income statement:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg35_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg35_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-8 Analyzing Revenues and Expenses and Completing an Income Statement

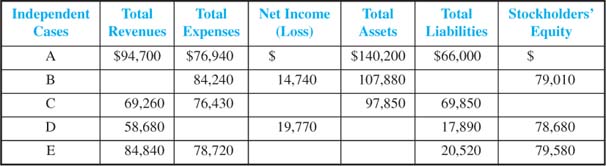

LO1 | Review the chapter explanations of the income statement and the balance sheet equations. Apply these equations in each independent case to compute the two missing amounts for each case. Assume that it is the end of 2010, the first full year of operations for the company. (Hint: Organize the listed items as they are presented in the balance sheet and income statement equations and then compute the missing amounts.)  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg35_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg35_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-9 Inferring Values Using the Income Statement and Balance Sheet Equations

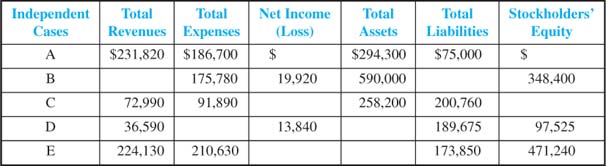

LO1 | Review the chapter explanations of the income statement and the balance sheet equations. Apply these equations in each independent case to compute the two missing amounts for each case. Assume that it is the end of 2011, the first full year of operations for the company. (Hint: Organize the listed items as they are presented in the balance sheet and income statement equations and then compute the missing amounts.)  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg35_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg35_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-10 Inferring Values Using the Income Statement and Balance Sheet Equations

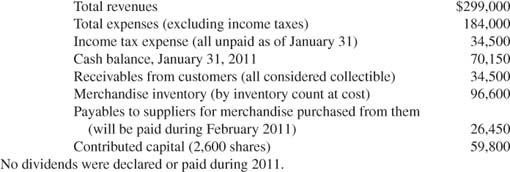

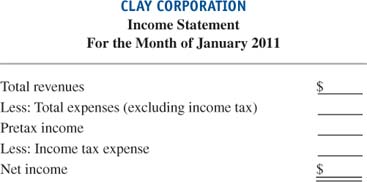

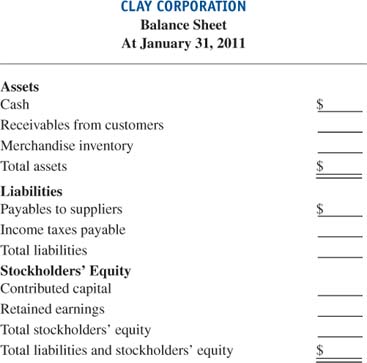

LO1 | Clay Corporation was organized by five individuals on January 1, 2011. At the end of January 2011, the following monthly financial data are available:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg36_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg36_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

No dividends were declared or paid during 2011. Required: Complete the following two statements:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg36_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg36_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg36_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg36_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| E1-11 Preparing an Income Statement and Balance Sheet

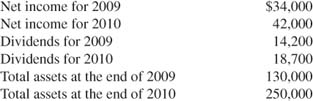

LO1 | Stone Culture Corporation was organized on January 1, 2009. For its first two years of operations, it reported the following:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg37_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg37_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Required: On the basis of the data given, prepare a statement of retained earnings for 2010. Show computations. | E1-12 Preparing a Statement of Retained Earnings

LO1 | The following items were taken from a recent cash flow statement. Note that different companies use slightly different titles for the same item. Without referring to Exhibit 1.5, mark each item in the list as a cash flow from operating activities (O), investing activities (I), or financing activities (F). Also place parentheses around the letter only if it is a cash outflow. ______ (1) Purchases of property, plant, and equipment ______ (2) Cash received from customers ______ (3) Cash paid for dividends to stockholders ______ (4) Cash paid to suppliers ______ (5) Income taxes paid ______ (6) Cash paid to employees ______ (7) Cash proceeds received from sale of investment in another company ______ (8) Repayment of borrowings

| E1-13 Focus on Cash Flows: Matching Cash Flow Statement Items to Categories

LO1 | NITSU Manufacturing Corporation is preparing the annual financial statements for the stockholders. A statement of cash flows must be prepared. The following data on cash flows were developed for the entire year ended December 31, 2011: cash collections from sales, $280,000; cash expended for operating expenses, $175,000; sale of unissued NITSU stock for cash, $30,000; cash dividends declared and paid to stockholders during the year, $18,000; and payments on long-term notes payable, $80,000. During the year, a tract of land held as an investment was sold for $10,000 cash (which was the same price that NITSU had paid for the land in 2010), and $48,000 cash was expended for two new machines. The machines were used in the factory. The beginning-of-the-year cash balance was $63,000. Required: Prepare the statement of cash flows for 2011. Follow the format illustrated in the chapter. | E1-14 Preparing a Statement of Cash Flows

LO1 |

*In the United States, “provision for income taxes” is most often used as a synonym for “income tax expense.” |