|

| 1 |  |

Living standards in ancient Rome remained relatively constant for 1000 years because: |

|  | A) | population increased at approximately the same rate as output, leaving output per person unchanged. |

|  | B) | average family sizes increased at the same rate as output per person. |

|  | C) | constant wars reduced the size of the population at the same rate as output was falling, leaving output per person unchanged. |

|  | D) | constant wars depleted the economy's capital stock, resulting in little or no growth of total output. |

|

|

|

| 2 |  |

Compared to the beginning of the Industrial Revolution, living standards around the world: |

|  | A) | have approximately tripled for both rich and poor countries, leaving the relative gap between rich and poor countries the same. |

|  | B) | have grown fastest in what were then the poorest countries, resulting in much less variation between rich and poor nations. |

|  | C) | currently show considerably more variation between rich and poor countries. |

|  | D) | show no marked trend regarding the gap between rich and poor countries. |

|

|

|

| 3 |  |

The purchase of corporate stock is considered: |

|  | A) | an economic investment. |

|  | B) | a financial investment. |

|  | C) | dissaving. |

|  | D) | the same as the purchase of new plant and equipment. |

|

|

|

| 4 |  |

If all prices could quickly adjust to unexpected changes in demand: |

|  | A) | output would fluctuate in inverse proportion to the price changes. |

|  | B) | output would remain constant and resources remain fully employed. |

|  | C) | output would fluctuate in direct proportion to the price changes. |

|  | D) | output would fluctuate in inverse proportion to changes in employment. |

|

|

|

| 5 |  |

If prices are inflexible, an unexpected reduction in demand for a firm's product would result in: |

|  | A) | rising inventories followed by cuts in production. |

|  | B) | falling inventories followed by cuts in production. |

|  | C) | immediate cuts in both production and desired inventory levels. |

|  | D) | rising inventories followed by increased employment of resources. |

|

|

|

| 6 |  |

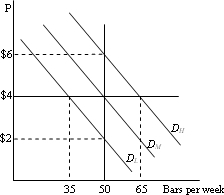

Refer to the following diagram:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511447/883751/ch23_q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511447/883751/ch23_q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a>

Suppose a factory minimizes its average costs by producing 50 metal bars per week. It can produce this output profitably at an expected price of $4 each, corresponding to expected demand of DM. With flexible prices, which of the following is the most likely initial consequence of a change in demand? |

|  | A) | Production will drop to 35 bars per week if demand unexpectedly falls to DL |

|  | B) | Production will rise to 65 bars per week if demand predictably rises to DH |

|  | C) | Profits will rise if demand unexpectedly rises to DH |

|  | D) | The price will rise to $6 and production will rise to 65 bars per week if demand unexpectedly rises to DH |

|

|

|

| 7 |  |

Which product would most likely be characterized by "sticky" prices? |

|  | A) | Feed corn |

|  | B) | Oil |

|  | C) | Natural gas |

|  | D) | Magazines |

|

|

|

| 8 |  |

The economy tends to exhibit short-run output fluctuations and long-run stability because: |

|  | A) | prices are more flexible in the short run than the long run. |

|  | B) | prices are more flexible in the long run than the short run. |

|  | C) | demand shocks are more common in the short run while supply shocks are more common in the long run. |

|  | D) | government and central bank policies are destabilizing in the short run but effective in the long run. |

|

|

|

| 9 |  |

An unexpected drop in consumer spending would be classified as a: |

|  | A) | negative demand shock. |

|  | B) | negative supply shock. |

|  | C) | positive demand shock. |

|  | D) | positive supply shock. |

|

|

|

| 10 |  |

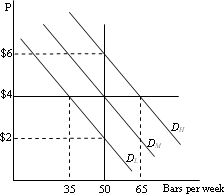

Refer to the following diagram:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511447/883751/ch23_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511447/883751/ch23_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

Suppose a factory minimizes its average costs by producing 50 metal bars per week. It can produce this output profitably at an expected price of $4 each, corresponding to expected demand of DM. Production will likely fall to 35 bars per week if: |

|  | A) | prices are flexible and demand unexpectedly falls to DL. |

|  | B) | prices are inflexible and demand unexpectedly falls to DL. |

|  | C) | prices are flexible and demand predictably falls to DL. |

|  | D) | the price unexpectedly falls to $2. |

|

|