|

| 1.

|  |

Suppose the equation for the money demand curve is MD = 65,000 – 15,000i, where i is the nominal interest rate. If inflation is 0.06 (6%) and the central bank wants to set the real rate of interest at 0.04 (4%) it must set a money supply equal to: |

|  | A) | 63,500 |

|  | B) | 64,400 |

|  | C) | 64,100 |

|  | D) | 64,970 |

|  | E) | 50,000 |

|

|

|

| 2.

|  |

To close an expansionary gap, the ECB must ____ real interest rates by ______ the money supply. |

|  | A) | Increase; increasing |

|  | B) | Increase; decreasing |

|  | C) | Decrease; not changing |

|  | D) | Decrease; increasing |

|  | E) | Decrease; decreasing |

|

|

|

| 3.

|  |

In an economy where aggregate demand is given by AD = 6,000 + .8Y - 20,000r, the central bank is currently setting the interest rate (r) at 0.05 (5percent). If potential output equals 26,000, the central bank must ____ the interest rate to _____percent to restore full employment. |

|  | A) | Lower; 0.03 |

|  | B) | Lower; 0.04 |

|  | C) | Raise; 0.06 |

|  | D) | Raise; 0.07 |

|  | E) | Raise; 0.08 |

|

|

|

| 4.

|  |

Suppose a central bank sets the real interest rate, r, according to the policy reaction function r = 2 + 0.5(p – p*), were p = the inflation rate and p* = the central bank's target for inflation. At what level would the central bank set the nominal rate of interest if the actual rate of inflation p = 6% and the target rate = 2%. |

|  | A) | 10% |

|  | B) | 8% |

|  | C) | 6% |

|  | D) | 4% |

|  | E) | 2% |

|

|

|

| 5.

|  |

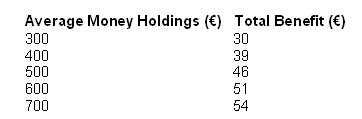

The following table shows Alex's estimated annual benefits of holding different amounts of money.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Table 1::/sites/dl/free/0077108310/329323/ch27table1.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Table 1 (16.0K)</a>Table 1 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Table 1::/sites/dl/free/0077108310/329323/ch27table1.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Table 1 (16.0K)</a>Table 1

How much money will Alex hold if the nominal interest rate is 8 percent? (Assume she wants her money holdings to be in multiples of €100.) |

|  | A) | 300 |

|  | B) | 400 |

|  | C) | 500 |

|  | D) | 600 |

|  | E) | 700 |

|

|

|

| 6.

|  |

Which of the following would be expected to increase the demand for

money?

A) |

|  | A) | Greater availability of ATM machines |

|  | B) | The economy enters a recession. |

|  | C) | An increase in the Consumer Price Index |

|  | D) | The introduction of faster and safer Internet on-line banking facilities |

|  | E) | Financial investors become less concerned about the

riskiness of shares |

|

|

|

| 7.

|  |

In the absence of central bank intervention, an increase in income will _____ money demand and _____ the nominal interest rate. |

|  | A) | Increase; increase |

|  | B) | Increase; decrease |

|  | C) | Not change; not change |

|  | D) | Decrease; decrease |

|  | E) | Decrease; increase |

|

|

|

| 8.

|  |

If the central bank increases the money supply, bond prices will _____ and the nominal interest rate will _____. |

|  | A) | Increase; increase |

|  | B) | Increase; decrease |

|  | C) | Do not change; does not change |

|  | D) | Decrease; decrease |

|  | E) | Decrease; increase |

|

|

|

| 9.

|  |

Retail sales rise significantly during the Christmas season. If the central bank takes no action we would expect to see a _____ in nominal interest rates and a _____ in the money supply: |

|  | A) | Rise; rise |

|  | B) | Rise; fall |

|  | C) | Rise: no change |

|  | D) | Fall; fall |

|  | E) | No change; rise |

|

|

|

| 10.

|  |

The central bank can affect planned aggregate expenditure and short-run equilibrium output by changing: |

|  | A) | Planned government spending. |

|  | B) | Tax revenue. |

|  | C) | Transfer payments. |

|  | D) | Real interest rates. |

|  | E) | The unemployment rate. |

|

|