|

| 1 | A continuous (or perpetual) budget

(Learning Objective 1 Ch 11) |

| A) | is prepared for a range of activity so that the budget can be adjusted for changes in activity. |

| B) | is a plan that is updated monthly or quarterly, dropping one period and adding another. |

| C) | is a strategic plan that does not change. |

| D) | is used in companies that experience no change in sales. |

|

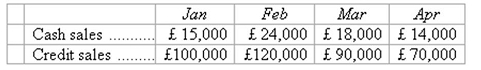

| 2 | Shown below is the sales forecast for Cooper Inc. for the first four months of the coming year.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q2::/sites/dl/free/0077121643/627780/CH11Q2.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q2 (27.0K)</a>Ad MCQs Ch11Q2 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q2::/sites/dl/free/0077121643/627780/CH11Q2.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q2 (27.0K)</a>Ad MCQs Ch11Q2

On average, 50% of credit sales are paid for in the month of the sale, 30% in the month following sale, and the remainder is paid two months after the month of the sale. Assuming there are no bad debts, the expected cash inflow in March is:

(Learning Objective 2 Ch 11) |

| A) | £138,000. |

| B) | £122,000. |

| C) | £119,000. |

| D) | £108,000. |

|

| 3 | Budgeted production needs are determined by:

(Learning Objective 3 Ch 11) |

| A) | adding budgeted sales in units to the desired ending inventory in units and deducting the beginning inventory in units from this total. |

| B) | adding budgeted sales in units to the beginning inventory in units and deducting the desired ending inventory in units from this total. |

| C) | adding budgeted sales in units to the desired ending inventory in units. |

| D) | deducting the beginning inventory in units from budgeted sales in units. |

|

| 4 | When preparing a materials purchase budget, desired ending inventory is deducted from the total needs of the period to arrive at materials to be purchased

(Learning Objective 4 Ch 11) |

| A) | True |

| B) | False |

|

| 5 | The direct labour budget is prepared in order to ensure that sufficient labour is available to meet production needs

(Learning Objective 5 Ch 11) |

| A) | True |

| B) | False |

|

| 6 | Which of the following is not correct regarding the manufacturing overhead budget?

(Learning Objective 6 Ch 11) |

| A) | Total budgeted cash disbursements for manufacturing overhead is equal to the total of budgeted variable and fixed manufacturing overhead. |

| B) | Manufacturing overhead costs should be broken down by cost behaviour. |

| C) | The manufacturing overhead budget should provide a schedule of all costs of production other than direct materials and direct labour. |

| D) | A schedule showing budgeted cash disbursements for manufacturing overhead should be prepared for use in developing the cash budget. |

|

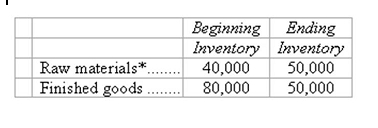

| 7 | Paradise Company budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for next year.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q7::/sites/dl/free/0077121643/627780/Ch11Q7.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q7 (24.0K)</a>Ad MCQs Ch11Q7 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q7::/sites/dl/free/0077121643/627780/Ch11Q7.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q7 (24.0K)</a>Ad MCQs Ch11Q7

If Paradise Company plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be

(Learning Objective 7 Ch 11) |

| A) | 440,000 units. |

| B) | 480,000 units. |

| C) | 510,000 units. |

| D) | 450,000 units. |

|

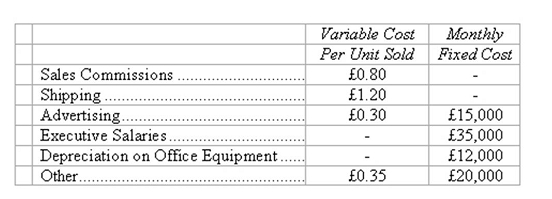

| 8 | The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its selling and administrative expense budget for the last half of the year. The following budget data are available:

French Division Cost Structure

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q8::/sites/dl/free/0077121643/627780/CH11Q8.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q8 (63.0K)</a>Ad MCQs Ch11Q8 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q8::/sites/dl/free/0077121643/627780/CH11Q8.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q8 (63.0K)</a>Ad MCQs Ch11Q8

If the French Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

(Learning Objective 8 Ch 11) |

| A) | £2.65. |

| B) | £3.28. |

| C) | £5.93. |

| D) | £5.45. |

|

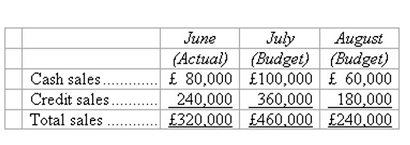

| 9 | Noskey Corporation is a merchandising firm. Information pertaining to the company's sales revenue is presented in the following table.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q9::/sites/dl/free/0077121643/627780/Ch11Q9.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q9 (39.0K)</a>Ad MCQs Ch11Q9 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch11Q9::/sites/dl/free/0077121643/627780/Ch11Q9.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch11Q9 (39.0K)</a>Ad MCQs Ch11Q9

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

Noskey Corporation's budgeted total cash payments in July for inventory purchases are:

(Learning Objective 9 Ch 11) |

| A) | £405,000. |

| B) | £283,500. |

| C) | £240,000. |

| D) | £168,000. |

|

| 10 | Which of the following represents the correct order in which the indicated budget documents for a manufacturing company would be prepared?

(Learning Objective 10 Ch 11) |

| A) | Sales budget, cash budget, direct materials budget, direct labour budget |

| B) | Production budget, sales budget, direct materials budget, direct labour budget |

| C) | Sales budget, cash budget, production budget, direct materials budget |

| D) | Selling and administrative expense budget, cash budget, budgeted income statement, budgeted balance sheet |