|

| 1 | Selling and administrative expenses are considered to be

(Learning Objective 1 Ch 6) |

| A) | a product cost under variable costing. |

| B) | a product cost under absorption costing. |

| C) | part of fixed manufacturing overhead under variable costing. |

| D) | a period cost under variable costing. |

|

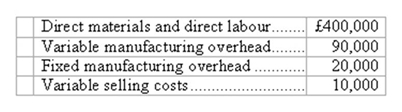

| 2 | During the month of April, Vane Co. produced and sold 10,000 units of a product. Manufacturing and selling costs incurred during April were as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch6 Q2::/sites/dl/free/0077121643/627780/Image1.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch6 Q2 (30.0K)</a>Ad MCQs Ch6 Q2 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch6 Q2::/sites/dl/free/0077121643/627780/Image1.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch6 Q2 (30.0K)</a>Ad MCQs Ch6 Q2

Assume that direct labour is a variable cost. The unit product cost under variable costing was

(Learning Objective 1 Ch 6) |

| A) | £49 |

| B) | £50 |

| C) | £51 |

| D) | £52 |

|

| 3 | The costs assigned to units in stock are typically lower under absorption costing than under variable costing

(Learning Objective 1 Ch 6) |

| A) | True |

| B) | False |

|

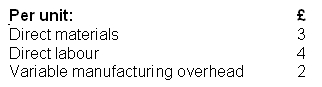

| 4 | The next 3 questions are based on the following information:

Alpha company produces a single product, with the following costs:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch6Q4::/sites/dl/free/0077121643/627780/Ch6Q4.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch6Q4 (15.0K)</a>Ad MCQs Ch6Q4 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::Ad MCQs Ch6Q4::/sites/dl/free/0077121643/627780/Ch6Q4.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif">Ad MCQs Ch6Q4 (15.0K)</a>Ad MCQs Ch6Q4

Variable cost per unit is:

(Learning Objective 1 Ch 6) |

| A) | £3 |

| B) | £7 |

| C) | £9 |

| D) | £11 |

|

| 5 | If Alpha has no opening stock at the beginning of the period, and sell 2,000 units during the period, for £15 each, what is their profit, using absorption costing?

(Learning Objective 2 Ch 6) |

| A) | -£2,500 |

| B) | £2,500 |

| C) | £7,000 |

| D) | £8,000 |

|

| 6 | What is the profit using variable costing?

(Learning Objective 3 Ch 6) |

| A) | -£2,500 |

| B) | £2,500 |

| C) | £7,000 |

| D) | £8,000 |

|

| 7 | When inventory levels increase over an accounting period:

(Learning Objective 4 Ch 6) |

| A) | Absorption costing will report a higher profit than variable costing |

| B) | Variable costing will report a higher profit than absorption costing |

| C) | The reported profit will be the same for both methods |

| D) | The inventory valuation will be the higher for variable costing than absorption costing |

|

| 8 | Profits move in the same direction as sales when variable costing is used if selling prices, the sales mix, and the cost structure remain the same.

(Learning Objective 4 Ch 6) |

| A) | True |

| B) | False |

|

| 9 | Advantages of using variable costing include (more than one may be right)

(Learning Objective 5 Ch 6) |

| A) | Variable costing complies with generally accepted accounting principles |

| B) | Variable costing ties in with cost control methods such as standard costs and flexible budgets |

| C) | With variable costing, the profit for a period is not affected by changes in stock. |

| D) | It is not necessary to keep two sets of records if variable costing is used. |

|

| 10 | A company using Just-in-Time (JIT) methods likely would show approximately the same net operating income under both absorption and variable costing because:

(Learning Objective 6 Ch 6) |

| A) | ending stock would be valued in the same manner for both methods under JIT. |

| B) | production is geared to sales under JIT and thus there would be little or no ending stock. |

| C) | under JIT fixed manufacturing overhead costs are charged to the period incurred rather than to the product produced. |

| D) | there is no distinction made under JIT between fixed and variable costs. |