|

| 1 |  |

All states employ a sales and use tax, income or franchise tax, and property tax. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

The state tax base is computed by making adjustments to book income. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

The sales and use tax base includes services in some states. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

Businesses must collect sales tax unless protected by Public Law 86-272. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

The Quill decision held that an out-of-state mail-order company did not have sales tax collection responsibility because it lacked physical presence. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

Public Law 86-272 protects sales of real property from creating nexus. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

The trade-show rule allows businesses to maintain a sample room for up to fourteen days in a state without creating nexus. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

Unitary return states require each member of a consolidated group with nexus to be included in the unitary state tax return. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

Which of the following is not a primary revenue source for most states? |

|  | A) | Income or franchise taxes |

|  | B) | Sales or use taxes |

|  | C) | Stock transfer taxes |

|  | D) | Property taxes |

|

|

|

| 10 |  |

Which of the items is correct regarding a use tax? |

|  | A) | Use taxes are imposed by every state. |

|  | B) | Sales tax and use taxes can both apply to a sale if a good is purchased in a state where sales tax is paid and then brought into a state with a higher sales and use tax is in effect. |

|  | C) | Amazon collects use taxes for all of its customers. |

|  | D) | States choose to implement either a sales tax or a use tax. |

|

|

|

| 11 |  |

Which of the following activities will create sales tax nexus? |

|  | A) | Advertising using television commercials. |

|  | B) | Salesmen who meet with customers in a state. |

|  | C) | Delivery of sales by UPS. |

|  | D) | Electronic delivery of software. |

|

|

|

| 12 |  |

Lucy operates a hat shop in Alexandria, Virginia. Lucy's also ships hats nationwide upon request. Lucy's Virginia sales are $500,000 and out of state sales are $300,000. Assuming that Virginia's sales tax rate is 6 percent, what is Lucy's Virginia sales and use tax liability? |

|  | A) | $0. |

|  | B) | $18,000. |

|  | C) | $30,000. |

|  | D) | $48,000. |

|

|

|

| 13 |  |

Which of the following isn't a requirement of Public Law 86-272? |

|  | A) | The tax is based on net income. |

|  | B) | The taxpayer sells only intangible personal property. |

|  | C) | The taxpayer is an interstate business. |

|  | D) | The taxpayer is nondomiciliary. |

|

|

|

| 14 |  |

Which of the following is not a general rule for calculating the sales factor? |

|  | A) | Tangible personal property sales are sourced to the destination state. |

|  | B) | If the business does not have nexus in the destination state, the sales are thrown back to the state where the goods were shipped from. |

|  | C) | Sales to a state where nexus exists, but no tax is imposed are thrown back to the state where the goods were shipped from. |

|  | D) | Government sales are sources to the state where they were shipped from. |

|

|

|

| 15 |  |

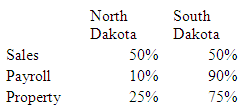

Shelby has the following sales, payroll and property factors:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007786235x/999075/Chapter_23img.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (79.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007786235x/999075/Chapter_23img.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (79.0K)</a>

What is Shelby's North Dakota apportionment factor if North Dakota uses a single factor sales formula? |

|  | A) | 50 percent. |

|  | B) | 10 percent. |

|  | C) | 25 percent. |

|  | D) | 28.33 percent. |

|

|