|

| 1 |  |

In 2004, GAAP expanded the definition of 'control' and addressed the definition and consolidation requirements for: |

|  | A) | Less than 50% owned subsidiaries. |

|  | B) | Foreign Subsidiaries. |

|  | C) | Permanently Impaired Subsidiaries. |

|  | D) | Variable Interest Entities. |

|  | E) | Entities financed with subordinated debt. |

|

|

|

| 2 |  |

Using the acquisition method, a company acquires all of the shares of stock of another company. In-process research and development exists and is estimated to have $300,000 fair value. How would you account for these costs? |

|  | A) | Always expense these costs at the acquisition date |

|  | B) | Expense these costs unless such costs represent assets with alternative future use |

|  | C) | Recognize these costs as an intangible asset and amortize the cost over a reasonable life |

|  | D) | Recognize these costs as an intangible asset and test for impairment |

|  | E) | These costs have no impact on the purchase. |

|

|

|

| 3 |  |

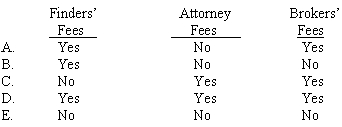

Using the acquisition method, which of the following costs incurred in bringing about a business combination accounted for as a purchase should enter into determining the net income of the combined company for the period in which the expenses are incurred? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|

|

| 4 |  |

In accounting for a business combination as a purchase, a bargain purchase exists when: |

|  | A) | purchase price > book value. |

|  | B) | fair value of net assets > purchase price or the fair value of the consideration. |

|  | C) | fair value of net assets < book value. |

|  | D) | fair value of net assets > book value. |

|  | E) | fair value of net assets < purchase price or the fair value of the consideration. |

|

|

|

| 5 |  |

Using the acquisition method, when a bargain purchase occurs and the net amount of the fair values of the separately identified assets and liabilities acquired exceed the fair value of the consideration transferred: |

|  | A) | assets are recorded at amounts below their assessed fair values. |

|  | B) | a gain on bargain purchase is recognized at the acquisition date. |

|  | C) | a loss on bargain purchase is recognized at the acquisition date. |

|  | D) | a contingent liability is recognized. |

|  | E) | Goodwill is recognized and tested for impairment on an annual basis. |

|

|

|

| 6 |  |

In preparing the consolidation worksheet for a business combination accounted for as a purchase using the purchase method, which one of the following is the appropriate basis for valuing fixed assets of a wholly-owned subsidiary? |

|  | A) | Fair value of the assets only |

|  | B) | Book value as shown on the books of the subsidiary |

|  | C) | Book value plus any excess of purchase price over book value of the acquired assets and liabilities |

|  | D) | Historical cost as shown on the books of the subsidiary |

|  | E) | Current carrying value |

|

|

|

| 7 |  |

On March 31, Jumbo purchases 100% of Larz for $7,500,000 cash and 2,200,000 shares of Jumbo voting common stock (par value of $1). Jumbo's stock had a fair value on March 31 of $40. Jumbo got 12,000,000 shares of Larz's voting common stock (par value $4) having a fair value of $50 per share. Jumbo incurs $5,000,000 in direct combination costs and $3,500,000 in stock issuance costs. Using the purchase method, what is Jumbo's COST for this acquisition? |

|  | A) | $100,500,000 |

|  | B) | $95,500,000 |

|  | C) | $99,000,000 |

|  | D) | $90,500,000 |

|  | E) | $97,000,000 |

|

|

|

| 8 |  |

On September 1, Mountainview Company acquired all of the outstanding common stock of Ward Company in a business combination accounted for as a pooling of interests. Both companies have a December 31 year-end and have been operating for five years. Consolidated net income for the year ended December 31 should include 12 months of net income for: |

|  | A) | only Mountainview. |

|  | B) | only Ward. |

|  | C) | neither Mountainview nor Ward. |

|  | D) | both Mountainview and Ward. |

|  | E) | Mountainview and Ward (if Ward's net income is at least 30% of consolidated net income). |

|

|

|

| 9 |  |

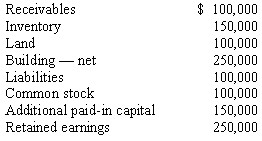

Shaw Company has the following account balances:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a>

Shaw's land has a fair value of $200,000, while its building has a fair value of $300,000. Shaw's liabilities have a fair value of $75,000. Brooks Company obtains all of the outstanding shares of Shaw for $750,000 cash. In the financial statements prepared immediately after the business combination, what is the amount of goodwill using the purchase method? |

|  | A) | $75,000 |

|  | B) | $100,000 |

|  | C) | $125,000 |

|  | D) | $250,000 |

|  | E) | $65,000 |

|

|

|

| 10 |  |

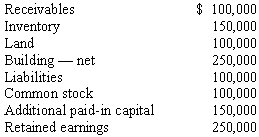

Shaw Company has the following account balances:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a>

Shaw's land has a fair value of $200,000, while its building has a fair value of $300,000. Shaw's liabilities have a fair value of $75,000. Brooks company acquires Shaw Company on December 31, by issuing 5,000 shares of $5 par value common stock valued at $150 per share. Direct combination costs of $20,000 are paid to third parties and Brooks Company has estimated a $40,000 contingent performance liability. In the financial statements prepared immediately after the business combination, what is the amount of goodwill using the acquisition method? |

|  | A) | $75,000 |

|  | B) | $100,000 |

|  | C) | $95,000 |

|  | D) | $115,000 |

|  | E) | $155,000 |

|

|

|

| 11 |  |

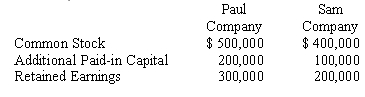

On December 31 of the current year, Sam Company was merged into Paul Company. In carrying out the business combination, Paul Company issued 60,000 shares of its $10 par value common stock, with a fair value of $15 per share, for all of Sam Company's outstanding common stock. The stockholders' equity section of the two companies immediately before the business combination was: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a>

Assume that the transaction is accounted for using the acquisition method. In the consolidated balance sheet at the end of the next year, the Additional Paid-In Capital account should be reported at: |

|  | A) | $400,000. |

|  | B) | $300,000. |

|  | C) | $500,000. |

|  | D) | $200,000. |

|  | E) | $100,000. |

|

|

|

| 12 |  |

Goodwill is generally defined as: |

|  | A) | Cost of the investment less the subsidiary's book value at the beginning of the year. |

|  | B) | Cost of the investment less the subsidiary's book value at the acquisition date. |

|  | C) | Cost of the investment less the fair value of the subsidiary's net assets and previously unrecorded intangible assets at the beginning of the year. |

|  | D) | Cost of the investment less the fair value of the subsidiary's net assets and previously unrecorded intangible assets at acquisition date. |

|  | E) | Is no longer allowed under Federal Law. |

|

|

|

| 13 |  |

To settle a difference of opinion regarding R. Obin's fair values, B. Atman promises to pay an additional $100,000 to the former owners if R. Obin's earnings exceed $500,000 during the next annual period. B. Atman estimates a 30% probability that the $100,000 contingent payment will be required. Assuming a discount rate of 4%, the present value factor is .961538. Under the acquisition method, what is the contingent liability? |

|  | A) | No contingent liability is recorded. |

|  | B) | $28,846 |

|  | C) | $30,000 |

|  | D) | $96,154 |

|  | E) | $100,000 |

|

|

|

| 14 |  |

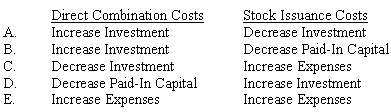

Direct combination costs and stock issuance costs are often incurred in the process of making a controlling investment in another company. Using the purchase method, how should those costs be accounted for in a purchase transaction? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q14.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q14.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|

|

| 15 |  |

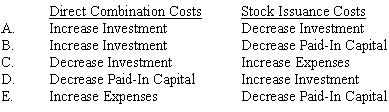

Direct combination costs and stock issuance costs are often incurred in the process of making a controlling investment in another company. Using the acquisition method, how should those costs be accounted for in a purchase transaction? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q15.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (29.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940321/ch02_q15.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (29.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|