|

| 1 |  |

The foreign exchange rate for the immediate delivery of currencies exchanged is called the: |

|  | A) | forward rate. |

|  | B) | historical rate. |

|  | C) | spot rate. |

|  | D) | market rate. |

|  | E) | swap rate. |

|

|

|

| 2 |  |

On November 1 of the current year, Patriot Inc. purchased a container of electrical components from its supplier in Japan. Patriot agreed to pay 15,000,000 ¥ in 90 days. The exchange rate on November 1 was $1 = 120 ¥. Patriot decided to hedge the transaction and entered into a 90 day forward contract to purchase yen at a cost of $1 = 125 ¥. The 60 day forward rate that would take Patriot to the December 31 fiscal year end was $1 = 127.50 ¥. On December 31, the spot rate was $1 = 118 ¥, and the 30-day forward rate was $1 = 122 ¥. What is the balance in the forward contract account on November 1 of the current year? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | $-0- |

|  | B) | $5,000 debit |

|  | C) | $5,000 credit |

|  | D) | $2,353 debit |

|  | E) | $7,353 credit |

|

|

|

| 3 |  |

On November 1 of the current year, Patriot Inc. purchased a container of electrical components from its supplier in Japan. Patriot agreed to pay 15,000,000 ¥ in 90 days. The exchange rate on November 1 was $1 = 120 ¥. Patriot decided to hedge the transaction and entered into a 90 day forward contract to purchase yen at a cost of $1 = 125 ¥. The 60 day forward rate that would take Patriot to the December 31 fiscal year end was $1 = 127.50 ¥. On December 31, the spot rate was $1 = 118 ¥, and the 30-day forward rate was $1 = 122 ¥. What is the balance in the forward contract account on December 31 of the current year? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | $7,119 debit |

|  | B) | $7,119 credit |

|  | C) | $2,951 debit |

|  | D) | $2,951 credit |

|  | E) | $120,000 debit |

|

|

|

| 4 |  |

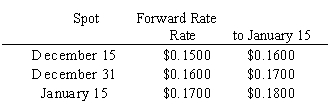

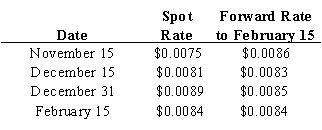

NOD Corp. (a U.S.-based company) sold parts to a Hong Kong customer on December 15 with payment of 100,000 Hong Kong dollars to be received in thirty days on January 15. The following exchange rates apply: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q4_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q4_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

Assuming no forward contract was entered into, how much foreign exchange gain or loss should NOD report on its December 31 income statement with regard to this transaction? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | no gain or loss |

|  | B) | $1,000 loss |

|  | C) | $3,000 loss |

|  | D) | $1,000 gain |

|  | E) | $3,000 gain |

|

|

|

| 5 |  |

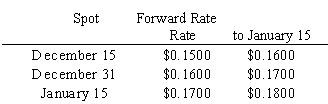

NOD Corp. (a U.S.-based company) sold parts to a Hong Kong customer on December 15 with payment of 100,000 Hong Kong dollars to be received in thirty days on January 15. The following exchange rates apply: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q5_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q5_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

Assuming a forward contract was entered into on December 15 to hedge this foreign currency transaction, what would be the net impact on income for year ending December 31? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | no impact on income |

|  | B) | $1,000 increase in income |

|  | C) | $1,000 decrease in income |

|  | D) | $2,000 increase in income |

|  | E) | $2,000 decrease in income |

|

|

|

| 6 |  |

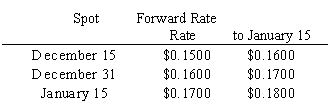

NOD Corp. (a U.S.-based company) sold parts to a Hong Kong customer on December 15 with payment of 100,000 Hong Kong dollars to be received in thirty days on January 15. The following exchange rates apply: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q6_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q6_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

Assuming a forward contract was entered into on December 15 to hedge this foreign currency transaction, what would be the net impact on income that should be recorded on January 15? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | no impact on income |

|  | B) | $1,000 increase in income |

|  | C) | $1,000 decrease in income |

|  | D) | $2,000 increase in income |

|  | E) | $2,000 decrease in income |

|

|

|

| 7 |  |

The price today at which a foreign currency can be purchased or sold in the future. |

|  | A) | forward rate. |

|  | B) | historical rate. |

|  | C) | spot rate. |

|  | D) | market rate. |

|  | E) | swap rate. |

|

|

|

| 8 |  |

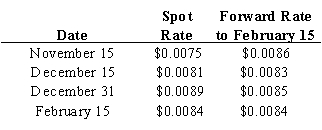

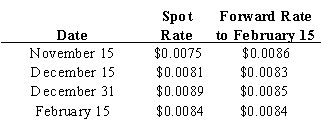

On December 15 of last year Duster Inc. entered into a forward contract to purchase 100,000¥ in sixty days. The relevant exchange rates are as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q8_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q8_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a>

Duster entered into the forward contract to hedge a purchase of inventory made on November 15 payable on February 15 of the next year. At December 15 of last year what is the fair value of this forward contract? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | $810 |

|  | B) | $830 |

|  | C) | $860 |

|  | D) | $20 |

|  | E) | $- 0 – |

|

|

|

| 9 |  |

On December 15 of last year Duster Inc. entered into a forward contract to purchase 100,000¥ in sixty days. The relevant exchange rates are as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q9_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q9_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a>

Referring to #8 above, what is the fair value of the forward contract on December 31? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | $20 debit |

|  | B) | $20 credit |

|  | C) | $60 debit |

|  | D) | $10 credit |

|  | E) | $- 0 – |

|

|

|

| 10 |  |

On December 15 of last year Duster Inc. entered into a forward contract to purchase 100,000¥ in sixty days. The relevant exchange rates are as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q10_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940329/ch9_q10_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a>

Referring again to the information in #8 above, what is the amount of gain or loss relating to this forward contract that Duster should record on February 15? (For purposes of this exercise, use a present value factor of 1.) |

|  | A) | $10 loss |

|  | B) | $20 loss |

|  | C) | $10 gain |

|  | D) | $20 gain |

|  | E) | $- 0 – |

|

|

|

| 11 |  |

The exchange rate at which the option will be executed if the holder decides to exercise the option is the: |

|  | A) | strike price. |

|  | B) | intrinsic value. |

|  | C) | spot rate. |

|  | D) | forward rate. |

|  | E) | option price. |

|

|

|

| 12 |  |

Using a forward contract to hedge a transaction that hasn’t taken place yet, but likely WILL take place (such as receiving an order for future delivery of goods from a customer) is: |

|  | A) | Not allowed by GAAP. |

|  | B) | Is called a Fair Value Hedge. |

|  | C) | Is called a Cash Flow Hedge. |

|  | D) | Is called a hedge of a firm commitment. |

|  | E) | Is called a hedge of a future commitment. |

|

|

|

| 13 |  |

Hedges of foreign currency firm commitments are used for: |

|  | A) | Sales only. |

|  | B) | Purchases only. |

|  | C) | Current purchases or sales. |

|  | D) | Future sales or purchases. |

|  | E) | None of the above. |

|

|

|

| 14 |  |

Which one of the following relationships between fluctuations in exchange rates and foreign exchange gains and losses is true? |

|  | A) | For an import purchase, a gain results when foreign currency appreciates. |

|  | B) | For an export sale, a loss results when foreign currency appreciates. |

|  | C) | For an export sale, a gain results when foreign currency appreciates. |

|  | D) | For an import purchase, a loss results when foreign currency depreciates. |

|  | E) | None of the above |

|

|

|

| 15 |  |

In accounting for foreign exchange currency, the United States uses: |

|  | A) | One-transaction perspective that defers foreign exchange gains and losses. |

|  | B) | One-transaction perspective that accrues foreign exchange gains and losses. |

|  | C) | Two-transaction perspective that defers foreign exchange gains and losses. |

|  | D) | Two-transaction perspective that accrues foreign exchange gains and losses. |

|  | E) | None of the above. |

|

|