|

| 1 |  |

_______________ refers to the set of procedures, tools, and systems organizations use to reach their goals. |

|  | A) | Variance analysis. |

|  | B) | Flexible budgeting. |

|  | C) | Capital budgeting. |

|  | D) | Control. |

|  | E) | None of the above. |

|

|

|

| 2 |  |

For any accounting period, the difference between the actual amount of operating income and the operating income contained in the master budget is referred to as the: |

|  | A) | net financial variance.. |

|  | B) | sales-volume variance. |

|  | C) | controllable variance. |

|  | D) | master budget variance. |

|  | E) | operational control variance.. |

|

|

|

| 3 |  |

The total static (master) budget variance for a period can be decomposed into: |

|  | A) | a production-volume variance and a sales-volume variance |

|  | B) | a total flexible-budget variance and a sales-volume variance |

|  | C) | an operating-income variance and a sales-volume variance |

|  | D) | an operating-income variance and a production-volume variance |

|  | E) | none of the above. |

|

|

|

| 4 |  |

The total flexible-budget variance for a period is equal to the difference between: |

|  | A) | actual operating income and the master budget operating income. |

|  | B) | the flexible budget at the output level of the period and the master budget operating income. |

|  | C) | the flexible budget at the input level of the period and the flexible budget at the output level of the period. |

|  | D) | actual operating income and the flexible budget operating income. |

|

|

|

| 5 |  |

From a control standpoint, standard cost variances should be recognized: |

|  | A) | coincidental with regular reporting intervals. |

|  | B) | as soon as possible. |

|  | C) | only when significant. |

|  | D) | only when negative. |

|  | E) | both answers C and D are correct |

|

|

|

| 6 |  |

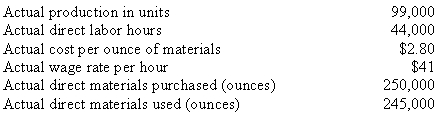

Barry Company's production budget for the year ended December 31 was based on 100,000 units using 240,000 ounces of the material PGA and 40,000 hours of direct labor. The standard costs are $3 per ounce for the material and $37.50 per hour for production workers. Selected actual operating data for the year ended December 31 are presented below. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q6_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q6_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

The direct materials purchase-price variance for the year ended December 31, 2010 is: |

|  | A) | $47,520 favorable |

|  | B) | $48,000 favorable |

|  | C) | $49,000 favorable |

|  | D) | $50,000 favorable |

|  | E) | None of the above. |

|

|

|

| 7 |  |

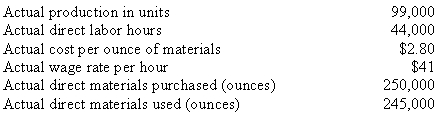

Barry Company's production budget for the year ended December 31 was based on 100,000 units using 240,000 ounces of the material PGA and 40,000 hours of direct labor. The standard costs are $3 per ounce for the material and $37.50 per hour for production workers. Selected actual operating data for the year ended December 31 are presented below. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

The direct materials usage variance for the year ended December 31, 2010 is: |

|  | A) | $15,000 unfavorable |

|  | B) | $20,720 unfavorable |

|  | C) | $22,200 unfavorable |

|  | D) | $34,720 unfavorable |

|  | E) | None of the above. |

|

|

|

| 8 |  |

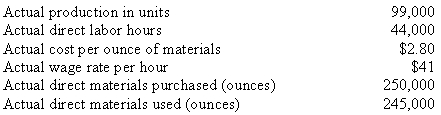

Barry Company's production budget for the year ended December 31 was based on 100,000 units using 240,000 ounces of the material PGA and 40,000 hours of direct labor. The standard costs are $3 per ounce for the material and $37.50 per hour for production workers. Selected actual operating data for the year ended December 31 are presented below. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q8_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q8_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

The direct labor rate variance for the year ended December 31, 2010 is: |

|  | A) | $69,300 unfavorable |

|  | B) | $70,000 unfavorable |

|  | C) | $138,600 unfavorable |

|  | D) | $140,000 unfavorable |

|  | E) | $154,000 unfavorable |

|

|

|

| 9 |  |

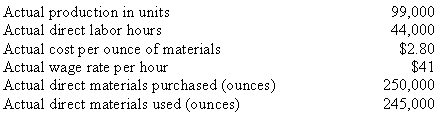

Barry Company's production budget for the year ended December 31 was based on 100,000 units using 240,000 ounces of the material PGA and 40,000 hours of direct labor. The standard costs are $3 per ounce for the material and $37.50 per hour for production workers. Selected actual operating data for the year ended December 31 are presented below. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q9_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966311/ch14_q9_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

The direct labor efficiency variance for the year ended December 31, 2010 is: |

|  | A) | $15,000 favorable |

|  | B) | $150,000 unfavorable |

|  | C) | $164,000 unfavorable |

|  | D) | $165,000 unfavorable |

|  | E) | $180,400 unfavorable |

|

|

|

| 10 |  |

Which of the following statements regarding standard costs is false: |

|  | A) | Ideal standards allow for normal amounts of downtime and inefficiency. |

|  | B) | Standard costs can be recorded in the formal accounting system of the organization. |

|  | C) | A standard cost system can be used in conjunction with either job-order costing or process costing. |

|  | D) | The use of ideal standards can have negative motivational effects on employee behavior. |

|  | E) | Participative standards are more apt to be accepted ("internalized") by employees and operating managers. |

|

|

|

| 11 |  |

Which of the following is not a limitation of standard costs and associated variances for operational control purposes? |

|  | A) | The use of such a reporting system typically involves significant implementation and upkeep costs. |

|  | B) | Operating personnel may not be able to readily interpret or act upon financial performance indicators, such as information contained in standard cost variances.. |

|  | C) | Standard cost variances are not forward-looking in the sense that they do not yield information regarding the drivers of future performance. |

|  | D) | Standard costs cannot be used in conjunction with job-order or process cost systems. |

|  | E) | All of the above are limitations of s. |

|

|

|

| 12 |  |

On April 5, 2010 Beta Company purchased 2,000 pounds of materials at $11 per pound. The standard cost sheet lists the cost at $10 per pound. The Production Department requisitioned 1,800 pounds for production of 925 units of output. Beta's standard direct material allowance per unit is 2 pounds. Beta uses a standard cost system (that is, it formally records standard costs and associated variances in its formal accounts). What is the direct material purchase-price variance? |

|  | A) | $2,000 unfavorable |

|  | B) | $1,800 unfavorable |

|  | C) | $1,800 favorable |

|  | D) | $2,000 favorable |

|

|

|

| 13 |  |

On April 5, 2010 Beta Company purchased 2,000 pounds of materials at $11 per pound. The standard cost sheet lists the cost at $10 per pound. The Production Department requisitioned 1,800 pounds for production of 925 units of output. Beta's standard direct material allowance per unit is 2 pounds. Beta uses a standard cost system (that is, it formally records standard costs and associated variances in its formal accounts). What is the direct material usage variance? |

|  | A) | $3,600 unfavorable |

|  | B) | $500 favorable |

|  | C) | $500 unfavorable |

|  | D) | $925 unfavorable |

|  | E) | $925 favorable |

|

|

|

| 14 |  |

On April 5, 2010 Beta Company purchased 2,000 pounds of materials at $11 per pound. The standard cost sheet lists the cost at $10 per pound. The Production Department requisitioned 1,800 pounds for production of 925 units of output. Beta's standard direct material allowance per unit is 2 pounds. Beta uses a standard cost system (that is, it formally records standard costs and associated variances in its formal accounts). Which of the following would be done when preparing the journal entry to record the purchase of direct materials (including any purchase-price variance)? |

|  | A) | Debit Direct Materials Inventory for $22,000. |

|  | B) | Credit Accounts Payable for $22,000. |

|  | C) | Credit Direct Materials Inventory for $20,000. |

|  | D) | Credit Direct Materials Price Variance for $2,000. |

|  | E) | Credit Direct Materials Inventory for $22,000. |

|

|

|

| 15 |  |

On April 5, 2010 Beta Company purchased 2,000 pounds of materials at $11 per pound. The standard cost sheet lists the cost at $10 per pound. The Production Department requisitioned 1,800 pounds for production of 925 units of output. Beta's standard direct material allowance per unit is 2 pounds. Beta uses a standard cost system (that is, it formally records standard costs and associated variances in its formal accounts). Which of the following would be done when preparing the journal entry to record the issuance of materials to production? |

|  | A) | Credit Direct Materials Inventory for $18,500. |

|  | B) | Credit WIP Inventory for $18,000. |

|  | C) | Debit Direct Materials Inventory for $18,000. |

|  | D) | Credit Direct Materials Usage Variance for $500. |

|  | E) | Both "A" and "C" are correct. |

|

|