|

| 1 |  |

The budgeting process impacts all of the following except? |

|  | A) | Resource allocation |

|  | B) | Communication and coordination among the departments of the business. |

|  | C) | Relationships with competitors |

|  | D) | The evaluation and control of actual performance |

|

|

|

| 2 |  |

Which of the following is true about budgetary slack? |

|  | A) | Budgetary slack is created when there is a difference between actual and budgeted amounts. |

|  | B) | Budgetary slack is created when a company uses normal rather than ideal standards when building their budget. |

|  | C) | Budgetary slack is created when a deliberate and unrealistic bias is introduced into the budgeting process. |

|  | D) | When budgeted amounts are the result of management's inability to be clairvoyant. |

|

|

|

| 3 |  |

The balanced scorecard approach is successful in reducing budgetary slack because: |

|  | A) | It uses several different measures to assess how successful a department performed. |

|  | B) | It uses actual results rather than estimated budgeted figures to measure performance. |

|  | C) | It uses only those measures that balance the budgeted figures with the actual figures. |

|  | D) | It uses those measures that make the assets balance with the liabilities and owners' equity. |

|

|

|

| 4 |  |

The strategy whereby a company uses the current period's budget as a starting point and input from the lower levels of the organization in preparing next period's budget is referred to as: |

|  | A) | incremental and mandated budgeting |

|  | B) | zero-based and participatory budgeting |

|  | C) | incremental and participatory budgeting |

|  | D) | zero-based and mandated budgeting |

|

|

|

| 5 |  |

Normal standards used in the budgeting process - |

|  | A) | Does not factor in operating inefficiencies in the budgeting process |

|  | B) | Allows budgetary slack into the budgeting process. |

|  | C) | Is based on ideal working conditions but allows for normal operating inefficiencies. |

|  | D) | Requires that deviations between actual and budgeted results be minimized. |

|

|

|

| 6 |  |

An advantage of a mandatory budget is: |

|  | A) | Employees input is mandated and therefore the quality of the budget is improved. |

|  | B) | Management has a better view of the long-term company goals and can build a budget that has a better chance of achieving these goals. |

|  | C) | Management does not have to waste time listening to employees views. |

|  | D) | Management can reduce employee morale by not having them worry about working on the budget. |

|

|

|

| 7 |  |

The dollar amount of cash received from sales would be considered when preparing the: |

|  | A) | Cash receipts schedule |

|  | B) | Sales budget |

|  | C) | Marketing and distribution budget |

|  | D) | Accounts receivables budget |

|

|

|

| 8 |  |

Conversion process planning consists of all the following except: |

|  | A) | scheduling labor |

|  | B) | scheduling production |

|  | C) | budgeting cash payments for materials used in production |

|  | D) | planning manufacturing overhead |

|

|

|

| 9 |  |

Which of the following is part of expenditure process planning? |

|  | A) | Sales budget |

|  | B) | Cash receipts budget |

|  | C) | Production budget |

|  | D) | Administrative Budget |

|

|

|

| 10 |  |

Which of the following is not part of expenditure process planning? |

|  | A) | Direct labor and overhead budget |

|  | B) | Direct materials purchases budget |

|  | C) | Cash disbursements schedule |

|  | D) | Production budget |

|

|

|

| 11 |  |

Spaulding Brothers' sales for January, 2010, were $1,900,000. Spaulding Brothers projects an 8% increase in sales every month through December. The sales for March, 2011, are estimated at: |

|  | A) | $2,052,000 |

|  | B) | $2,584,929 |

|  | C) | $2,393,453 |

|  | D) | $2,216,160 |

|

|

|

| 12 |  |

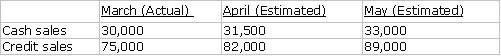

State Corporation's sales price is $40 per unit. Unit sales information is presented below:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Management estimates that 2% of credit sales are uncollectible. Of the remaining credit sales, 20 percent are collected in the month of sale and the remainder in the following month. The March 31 ending inventory is 11,000 units, and State wants to have 10% of the next month's sales in ending finished goods inventory.

What are State Corporation's expected cash collections for April? |

|  | A) | $4,254,880 |

|  | B) | $2,000,000 |

|  | C) | $4,336,000 |

|  | D) | $3,600,000 |

|

|

|

| 13 |  |

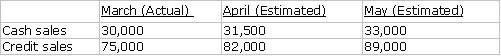

State Corporation's sales price is $40 per unit. Unit sales information is presented below:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

How many units should State produce during April? |

|  | A) | 114,700 |

|  | B) | 104,600 |

|  | C) | 93,000 |

|  | D) | 104,000 |

|

|

|

| 14 |  |

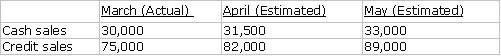

State Corporation's sales price is $40 per unit. Unit sales information is presented below:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Each finished unit requires 10 units of raw material and raw material can be purchased at $3 per unit. State wants to have 15% of the next month's needs in ending raw materials inventory. The March 31, raw materials inventory is 60,000 units and State estimates May production at 116,000 units. What amount should State budget for raw material purchases for April? |

|  | A) | $3,783,000 |

|  | B) | $5,800,000 |

|  | C) | $5,200,000 |

|  | D) | $4,630,000 |

|

|

|

| 15 |  |

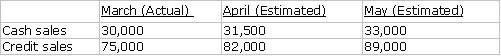

State Corporation's sales price is $40 per unit. Unit sales information is presented below:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136601/794875/image001.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Each finished unit requires 2 direct labor hours. The average direct labor rate is $14 per hour. What amount should State budget for direct labor for April? |

|  | A) | $3,236,800 |

|  | B) | $3,211,600 |

|  | C) | $2,928,800 |

|  | D) | $3,544,800 |

|

|