|

| 1 |  |

The weighted-average-cost method of inventory valuation is used because it is consistent with the physical flow of inventory items. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

The perpetual inventory system provides management with more up-to-date information. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

Nearly all companies take a physical count of inventory at least once each year |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

The cost of an inventory item includes its invoice cost minus any discount, and plus any other costs necessary to put it in a place and condition for sale. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

Goods in transit that were sold on the basis of FOB destination are not included in the inventory of the seller. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

It is necessary to take a physical inventory when using a perpetual inventory system. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

FIFO assumes costs flow in the order incurred. The first units purchased are assumed to be the first units sold. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

The cost figure determined by the different methods may have nothing to do with the actual physical flow of goods. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

Of the four inventory methods, LIFO will result in the highest net income during periods of rising prices. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

In periods of rising prices, the FIFO inventory will result in a smaller ending inventory value than will the weighted-average-cost method. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

FIFO and LIFO represent different assumptions about the flow of costs in a business. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

A company has made two inventory purchases during the month. The first purchase was made on June 5. The second purchase was made on June 9. If the company uses the LIFO cost flow assumption, the goods purchased on June 9 will be assumed to be sold first. |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

A company has made two inventory purchases during the month. The first purchase of 100 units was made on June 5. The second purchase of 100 units was made on June 9. At the end of the period 75 units remain in ending inventory. If the company uses the FIFO cost flow assumption, ending inventory consists of units from the June 9 purchase. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

Companies using the LIFO cost flow assumption will pay the highest income taxes during periods of rising prices. |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

Days' sales in inventory, also called days' stock on hand, is a ratio that reveals how much inventory is available in terms of the number of days' sales. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

A fundamental rule of accounting which says that firms may not repeatedly switch methods of inventory valuation is |

|  | A) | the accrual basis of accounting. |

|  | B) | the consistency principle. |

|  | C) | the matching principle. |

|  | D) | the cost principle. |

|  | E) | none of these. |

|

|

|

| 17 |  |

Forgetting to count a portion of the goods in a warehouse as ending inventory will result in |

|  | A) | overstating total liabilities. |

|  | B) | overstating total assets. |

|  | C) | understating net income. |

|  | D) | overstating net income. |

|  | E) | none of these. |

|

|

|

| 18 |  |

Goods in transit would normally be included in the inventory of |

|  | A) | the buyer when the goods have been shipped FOB shipping point. |

|  | B) | neither the buyer nor the seller, regardless of FOB status. |

|  | C) | the buyer when the goods have been shipped FOB destination. |

|  | D) | the seller when the goods have been shipped FOB shipping point. |

|  | E) | none of these. |

|

|

|

| 19 |  |

If Goods Available for Sale were $5,928 and ending inventory costs were 6 units at $56 each, 4 units at $54 each, and 8 units at $58 each, the Cost of Goods Sold using the specific identification method would be |

|  | A) | $5,248. |

|  | B) | $4,064. |

|  | C) | $4,912. |

|  | D) | $6,096. |

|  | E) | none of these. |

|

|

|

| 20 |  |

Four methods are commonly used to assign costs to inventory and to cost of goods sold; which of the following is NOT one of those methods |

|  | A) | First in First out. |

|  | B) | Last in Last out |

|  | C) | Specific Identification. |

|  | D) | Weighted Average. |

|  | E) | none of these. |

|

|

|

| 21 |  |

Under the periodic inventory system, the sale of goods is recorded by |

|  | A) | a debit to Accounts Receivable and a credit to Purchases. |

|  | B) | a debit to Purchases and a credit to Sales. |

|  | C) | a debit to Merchandise Inventory and a credit to Cost of Goods Sold. |

|  | D) | a credit to Sales and a debit to Accounts Receivable. |

|  | E) | none of these. |

|

|

|

| 22 |  |

The method of inventory costing that is based on the cost flow assumption that goods sold are sold in the order acquired |

|  | A) | LIFO. |

|  | B) | specific identification. |

|  | C) | weighted average cost. |

|  | D) | FIFO. |

|  | E) | none of these. |

|

|

|

| 23 |  |

If prices of goods are rising, LIFO yields |

|  | A) | highest gross profit, highest income taxes. |

|  | B) | lowest gross profit, lowest income taxes. |

|  | C) | highest gross profit, lowest income taxes. |

|  | D) | lowest gross profit, highest income taxes. |

|  | E) | none of these. |

|

|

|

| 24 |  |

Inventory turnover, also called merchandise inventory turnover, is one ratio used to assess a merchandiser's ability to pay its short-term obligations. The ratio is figured by |

|  | A) | Ending inventory divided by Cost of Goods Sold x 365 days |

|  | B) | Average inventory divided by Cost of Goods Sold. |

|  | C) | Cost of Goods Sold divided by Average inventory. |

|  | D) | Ending Inventory/Average inventory. |

|  | E) | none of these. |

|

|

|

| 25 |  |

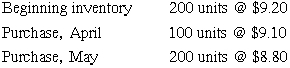

Assume:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802448/ch17_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802448/ch17_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

A physical inventory is taken in June. If the ending inventory is 170 units, the amount of the ending inventory under FIFO is |

|  | A) | $1,656. |

|  | B) | $1,611. |

|  | C) | $1,496. |

|  | D) | $1,648. |

|  | E) | none of these. |

|

|

|

| 26 |  |

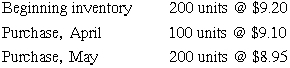

Assume:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802448/ch17_11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802448/ch17_11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

A physical inventory is taken in June. If the ending inventory is 180 units, the amount of the ending inventory under the weighted-average-cost method is |

|  | A) | $1,635.00. |

|  | B) | $2,724.00. |

|  | C) | $2,043.00. |

|  | D) | $1,634.40. |

|  | E) | none of these. |

|

|

|

| 27 |  |

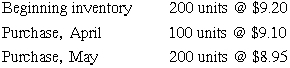

Assume:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802448/ch17_11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802448/ch17_11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

A physical inventory is taken in June. If the ending inventory is 180 units, the amount of the ending inventory under LIFO is |

|  | A) | $1,623. |

|  | B) | $1,656. |

|  | C) | $1,648. |

|  | D) | $1,611. |

|  | E) | none of these. |

|

|

|

| 28 |  |

For an accounting period, if net sales amount to $180,000, delivered cost of purchases amounts to $93,000, beginning inventory amounts to $54,000, and ending merchandise inventory amounts to $88,000, cost of goods sold amounts to |

|  | A) | $61,000. |

|  | B) | $93,000. |

|  | C) | $59,000. |

|  | D) | $88,000. |

|  | E) | none of these. |

|

|

|

| 29 |  |

The method used in which the ending inventory is valued at the most recent costs is |

|  | A) | FIFO. |

|  | B) | weighted. |

|  | C) | LIFO. |

|  | D) | average cost. |

|  | E) | none of these. |

|

|

|

| 30 |  |

If LCM is applied to the individual items of inventory and it is determined that the inventory must be adjusted from the $250,000 recorded cost down to the $235,000 market amount. The decline in inventory value (of $15,000) is included on the income statement. This adjusting entry would include |

|  | A) | debit to Merchandise inventory for $15,000. |

|  | B) | debit to Purchases for $15,000. |

|  | C) | credit to Purchases for $15,000. |

|  | D) | credit to Merchandise inventory for $15,000. |

|  | E) | none of these. |

|

|