|

| 1 |  |

A statement of cash flows and the income statement are the only two statements that explain the reasons for inflows and outflows of cash. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

Cash equivalents are long-term, highly liquid investments. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

The main purpose of a statement of cash flows is to provide a summary of information concerning a company's cash receipts and payments during a fiscal period. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

The direct method of presenting a statement of cash flows involves adjusting net income for increases and decreases in current assets and current liability accounts. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

A company cannot have a net income and still have a negative cash flow. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

On a statement of cash flows, gain on the sale of equipment is listed in the Operating Activities section if the indirect method is used. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

An increase in merchandise inventory will be shown as a decrease in the Operating activities section of the statement of cash flows if the indirect method is used. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

It is possible for a company to have a net loss and a positive cash flow. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

If the ending Prepaid Insurance is greater than the beginning Prepaid Insurance, the cash paid for insurance during the fiscal period is more than the amount listed as Insurance Expense. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

On a statement of cash flows, the issuance of common stock at par is listed under Financing Activities. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

There are two methods of preparing the Operating Activities section of a statement of cash flows. One is the direct method and one is the indirect method. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

The net cash amount provided by operating activities is identical under both the direct and indirect methods. |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

If cash received from the sale of equipment was $10,000 and there was a gain of $2,000 reported on the sale on the income statement, the amount of cash received would be reported in the operating activities section of the statement of cash flows. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

On a statement of cash flows, using the indirect method, the increase in Salaries Payable would be reported in the Financing Activities as a decrease in cash. |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

On a statement of cash flows, there are three sections: the operating, investing and financing sections. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

Which of the following will not appear on a statement of cash flows under Financing Activities? |

|  | A) | issuance of a note |

|  | B) | purchase of equipment |

|  | C) | issuance of common stock |

|  | D) | payment of cash dividends |

|  | E) | none of these |

|

|

|

| 17 |  |

Equipment having a cost of $8,100 and accumulated depreciation of $5,600 is sold at a gain of $500. How is this shown on the statement of cash flows? |

|  | A) | $3,000 is listed as sale of equipment under Investing Activities. |

|  | B) | $2,000 is listed as sale of equipment under Investing Activities. |

|  | C) | $2,000 is listed as sale of equipment under Financing Activities. |

|  | D) | $3,000 is listed as sale of equipment under Financing Activities. |

|  | E) | None of these is true. |

|

|

|

| 18 |  |

Which of the following is listed on a statement of cash flows? |

|  | A) | increase in accounts Receivable |

|  | B) | gains on the sale of equipment |

|  | C) | amount of dividends paid by a company |

|  | D) | all of these |

|  | E) | none of these |

|

|

|

| 19 |  |

Interest Expense appearing on an income statement amounts to $860. Between the beginning and the end of the year, Interest Payable has decreased by $180. On a statement of cash flows using the Indirect method, |

|  | A) | an increase in interest expense of $860 will be reported in the Investing Activities section as a decrease in cash. |

|  | B) | a decrease in interest payable of $180 will be reported in the Investing Activities section as a decrease in cash. |

|  | C) | a decrease in interest payable of $180 will be reported in the Operating Activities section as an increase in cash. |

|  | D) | a decrease in interest payable of $180 will be reported in the Financing Activities section as a decrease in cash. |

|  | E) | None of these is listed. |

|

|

|

| 20 |  |

Harris Company received cash of $19,000 from issuing 5,000 shares of common stock. On the Statement of Cash flows, this transaction will be reported as |

|  | A) | $19,000 increase in cash in the Financing Activities section. |

|  | B) | $19,000 decrease in cash in the Financing Activities section. |

|  | C) | $19,000 increase in cash in the Investing Activities section. |

|  | D) | $19,000 increase in cash in the Operating Activities section. |

|  | E) | none of these. |

|

|

|

| 21 |  |

Dividends paid during the year of $18,500, is listed on the statement of cash flows as |

|  | A) | a negative amount under financing activities. |

|  | B) | a positive amount under financing activities. |

|  | C) | a negative amount under operating activities. |

|  | D) | a positive amount under operating activities. |

|  | E) | none of these. |

|

|

|

| 22 |  |

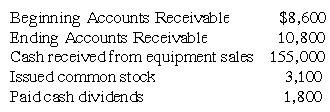

From the following information, figure cash flows from Investing Activities.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802453/q17.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802453/q17.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

|

|  | A) | $155,000 increase in cash |

|  | B) | $1,400 use of cash |

|  | C) | $2,200 decrease in cash |

|  | D) | $156,300 increase in cash |

|  | E) | none of these |

|

|

|

| 23 |  |

Harris Company received cash of $19,000 from selling equipment that had a book value of $21,000. On the Statement of Cash flows, using the Indirect method, this transaction will be reported as |

|  | A) | $2,000 increase in the Operating Activities section. |

|  | B) | $19,000 increase in the Financing Activities section. |

|  | C) | $2,000 decrease in the Investing Activities section. |

|  | D) | $2,000 decrease in the Operating Activities section. |

|  | E) | none of these. |

|

|

|

| 24 |  |

If Salaries Payable increased from $3,300 to $4,700, this change would be reported on the statement of cash flows, using the Indirect method as |

|  | A) | a decrease of $4,700 in the operating activities section. |

|  | B) | an increase of $1,400 in the operating activities section |

|  | C) | a decrease of $1,400 in the operating activities section. |

|  | D) | an increase of $1,400 in the investing activities section |

|  | E) | none of these. |

|

|

|

| 25 |  |

If Supplies Expense is $2,300, beginning Supplies was $1,700, and ending Supplies is $1,100, the cash used for supplies on the statement of cash flows, using the indirect method, will be reported |

|  | A) | a decrease of $600 in the operating activities section |

|  | B) | an increase of $600 in the operating activities section. |

|  | C) | a decrease of $2,300 in the operating activities section. |

|  | D) | a decrease of $1,700 in the operating activities section |

|  | E) | none of these. |

|

|

|

| 26 |  |

If Accounts Receivable increased from $3,300 to $4,700, this change would be reported on the statement of cash flows, using the Indirect method as |

|  | A) | a decrease of $4,700 in the operating activities section. |

|  | B) | an increase of $1,400 in the operating activities section |

|  | C) | a decrease of $1,400 in the operating activities section. |

|  | D) | an increase of $1,400 in the investing activities section |

|  | E) | none of these. |

|

|

|

| 27 |  |

Merchandise inventory decreases by $10,000, from a $70,000 beginning balance to a $60,000 ending balance. This change would be reported as |

|  | A) | a decrease of $10,000 in the operating activities section. |

|  | B) | an increase of $10,000 in the operating activities section |

|  | C) | a decrease of $10,000 in the investing activities section. |

|  | D) | an increase of $10,000 in the investing activities section |

|  | E) | none of these. |

|

|

|

| 28 |  |

ABC Co. sold a piece of equipment for $4,000. It had an original cost of $6,000 with accumulated depreciation of $1,500. This transaction would be recorded on the statement of cash flows as |

|  | A) | an increase of $500 in the operating activities section. |

|  | B) | an increase of $4,000 in the operating activities section |

|  | C) | a decrease of $500 in the operating activities section. |

|  | D) | an increase of $4,000 in the financing activities section |

|  | E) | none of these. |

|

|

|

| 29 |  |

Information in the statement of cash flows helps address all of the following questions EXCEPT |

|  | A) | What expenditures are made with cash from operations. |

|  | B) | Why a customer did not pay a bill. |

|  | C) | What is the source of cash for distributions to stockholders. |

|  | D) | How much cash is generated from or used in operations |

|  | E) | all of these. |

|

|

|

| 30 |  |

The beginning balance in Retained Earnings is $10,000 and the ending balance is $15,000. The company reported net income of $16,000. What was the amount of dividends that were paid this year? |

|  | A) | $0 |

|  | B) | $5,000 |

|  | C) | $1,000 |

|  | D) | $6,000 |

|  | E) | none of these |

|

|