|

| 1 |  |

Financial statement analysis provides an opportunity to determine solvency and profitability. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

Book value per share equals total stockholders' equity available to a class of stock divided by the number of shares issued and outstanding. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

The higher the accounts receivable turnover, the less time is needed to collect accounts. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

Of the two financial statements used in horizontal analysis, the later statement represents the base year. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

In vertical analysis of an income statement, each item is stated as a percentage of gross profit. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

A useful basis for analyzing financial information is a comparison of statements from the same company for the current and one or more prior years. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

A cash collection of a customer's charge account increases working capital. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

Ratios are among the more widely used tools of financial analysis because they provide clues to and symptoms of underlying conditions. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

Common-size statements involve horizontal analysis of a company's financial statements. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

Merchandise inventory is NOT considered to be a quick asset. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

Equipment is considered to be a liquid asset. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

Dividend yield is used to compare the dividend-paying performance of different investment alternatives. |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

Return on common stockholders' equity measures a company's liquidity. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

A company's operating efficiency and profitability can be expressed with the price-earnings ratio. |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

External users rely on financial statement analysis to make better and more informed decisions in pursuing their own goals. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

The current ratio equals |

|  | A) | current assets plus current liabilities. |

|  | B) | current assets minus current liabilities. |

|  | C) | quick assets divided by current liabilities. |

|  | D) | current assets divided by total assets. |

|  | E) | none of these. |

|

|

|

| 17 |  |

What happens to working capital when cash is paid to a short-term creditor? |

|  | A) | Plant and equipment is increased. |

|  | B) | Plant and equipment is decreased. |

|  | C) | Working capital does not change. |

|  | D) | Working capital increases. |

|  | E) | Working capital decreases. |

|

|

|

| 18 |  |

Lester Corporation does not have any preferred stock. The corporation's total liabilities are $265,000, total expenses are $210,000, total stockholders' equity is $422,000, and revenue is $266,000. What is the rate of return on common stockholders' equity? |

|  | A) | 13.27 percent |

|  | B) | 62.8 percent |

|  | C) | 13.03 percent |

|  | D) | 21.1 percent |

|  | E) | none of these |

|

|

|

| 19 |  |

When total stockholders' equity available to common stockholders is divided by the number of common shares issued and outstanding, the result is |

|  | A) | book value per share of common stock. |

|  | B) | the rate of return on common stockholders' equity. |

|  | C) | the earnings per share of common stock. |

|  | D) | the price-earnings ratio on common stock. |

|  | E) | none of these. |

|

|

|

| 20 |  |

When calculating inventory turnover, which of the following appears in the numerator (top)? |

|  | A) | net sales |

|  | B) | average merchandise inventory |

|  | C) | cost of goods sold |

|  | D) | gross profit |

|  | E) | none of these |

|

|

|

| 21 |  |

Inventory turnover is equal to |

|  | A) | average inventory divided by cost of goods sold. |

|  | B) | total assets divided by average inventory. |

|  | C) | net income divided by average inventory. |

|  | D) | cost of goods sold divided by average inventory. |

|  | E) | none of these. |

|

|

|

| 22 |  |

Describe the effect of the following journal entry on working capital: debit Accumulated Depreciation, Equipment, $1,000; credit Equipment, $1,000. |

|  | A) | Working capital is increased. |

|  | B) | Working capital is not affected. |

|  | C) | Net income is increased. |

|  | D) | Working capital is decreased. |

|  | E) | Net income is decreased. |

|

|

|

| 23 |  |

The Solvency of a company refers to its |

|  | A) | ability to meet short-term obligations and to efficiently generate revenues. |

|  | B) | ability to generate positive market expectations |

|  | C) | ability to generate future revenues and meet long-term obligations. |

|  | D) | ability to provide financial rewards sufficient to attract and retain financing. |

|  | E) | none of the above. |

|

|

|

| 24 |  |

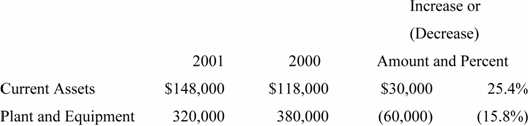

What type of analysis is indicated by the following?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802455/q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802455/q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> |

|  | A) | differential analysis |

|  | B) | vertical analysis |

|  | C) | balance sheet analysis |

|  | D) | horizontal analysis |

|  | E) | none of these |

|

|

|

| 25 |  |

Osborn Corporation's accounts show the following: Current Assets total, $300,000; Building, $500,000; Equipment, $130,000; Current Liabilities total, $45,000; Long-Term Liabilities total, $175,000. The ratio of the value of plant and equipment to long-term liabilities is |

|  | A) | 3.41. |

|  | B) | 3.60. |

|  | C) | 2.31. |

|  | D) | 2.89. |

|  | E) | 3.87. |

|

|

|

| 26 |  |

Which of the following is true about accounts receivable turnover analysis? |

|  | A) | Turnover is computed by dividing net sales on account by average net accounts receivable. |

|  | B) | Turnover implies a sale on account followed by a payment of the debt in cash or a write-off. |

|  | C) | Turnover is the number of times charge accounts are paid off per year. |

|  | D) | all of these |

|  | E) | none of these |

|

|

|

| 27 |  |

Equity ratio is equal to |

|  | A) | average common shares outstanding divided by total equity. |

|  | B) | total assets divided by total equity. |

|  | C) | total equity divided by total liabilities. |

|  | D) | Average stockholder's equity divided by average current assets. |

|  | E) | none of these. |

|

|

|

| 28 |  |

Profit margin ratio is equal to |

|  | A) | Gross profit divided by net sales. |

|  | B) | Net income divided by average total assets. |

|  | C) | Net income divided by net sales. |

|  | D) | Net sales divided by average gross profit. |

|  | E) | none of these. |

|

|

|

| 29 |  |

General-purpose financial statements include all of the following EXCEPT |

|  | A) | statement of stockholders' |

|  | B) | balance sheet |

|  | C) | the profit and gross margin statement |

|  | D) | statement of cash flows |

|  | E) | all of the above are financial statements |

|

|

|

| 30 |  |

On common-size comparative income statements, each item is shown as a percent of |

|  | A) | net sales for that period |

|  | B) | total assets for the period |

|  | C) | total liabilities for the period |

|  | D) | net income for the period |

|

|