|

| 1 |  |

While a job is being produced, its accumulated costs are kept in the general ledger account Goods in Process Inventory. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

Job-order costing is used in those situations where units of a product are homogeneous, such as in the manufacture of sugar. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

The three cost categories appearing on a job cost sheet are: selling expense, manufacturing expense, and administrative expense. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

A job cost sheet is used to accumulate costs charged to a job. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

The use of predetermined overhead rates in a job order cost system makes it possible to estimate the total cost of a given job as soon as production is completed. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

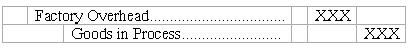

The following journal entry would be made to apply overhead cost to jobs in a job-order costing system:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802457/q6_q.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802457/q6_q.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

Under a job-order cost system the Work in Process account is debited with the cost of materials purchased. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

The process of assigning overhead cost to jobs is known as applying overhead. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

The cost of a completed job in a job-order costing system typically consists of the actual materials cost of the job, the actual labor cost of the job, and the actual amount of manufacturing overhead cost of the job. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

The sum of all amounts transferred from the Goods in Process Inventory account and into the Finished Goods Inventory account represents the Cost of Goods Manufactured for the period. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

The collection of job cost sheets for all jobs in process makes up a subsidiary ledger controlled by the Goods in Process Inventory account. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

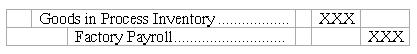

When time tickets report labor used on a specific job, this cost is recorded as direct labor. The following journal entry would be made to charge direct labor to jobs in a job-order costing system:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802457/q12_q.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802457/q12_q.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

ABC Co.'s predetermined overhead rate is 140% of direct labor cost. If a company incurred actual overhead costs of $100,000 during the period and $6,000 of direct labor went into job 1234. Then overhead applied to job 1234 would be $84,000. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

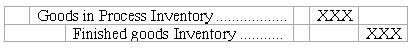

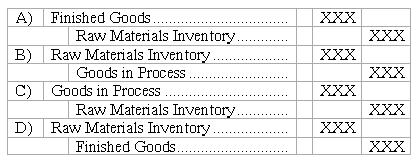

When specific jobs are COMPLETED, the following journal entry would be made in a job-order costing system:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802457/q14_q.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802457/q14_q.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

When less overhead is applied than is actually incurred, the remaining debit balance in the Factory Overhead account at the end of the period is called underapplied overhead. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

The manufacturing operation that would be most likely to use a job-order costing system is: |

|  | A) | toy manufacturing. |

|  | B) | candy manufacturing. |

|  | C) | crude oil refining. |

|  | D) | shipbuilding. |

|

|

|

| 17 |  |

All of the following are major cost categories that you would find on a job order cost sheet EXCEPT? |

|  | A) | Direct Materials. |

|  | B) | Overhead. |

|  | C) | Indirect Materials. |

|  | D) | Direct Labor. |

|

|

|

| 18 |  |

In computing its predetermined overhead rate, Brady Company included its factory insurance cost twice. This error will result in: |

|  | A) | the ending balance of Finished Goods to be understated. |

|  | B) | the credits to the Manufacturing Overhead account to be understated. |

|  | C) | the Cost of Goods Manufactured to be overstated. |

|  | D) | the Net Operating Income to be overstated. |

|

|

|

| 19 |  |

In a job-order cost system, the application of manufacturing overhead usually would be recorded as a debit to: |

|  | A) | Cost of Goods Sold. |

|  | B) | Goods in Process inventory. |

|  | C) | Factory Overhead. |

|  | D) | Finished Goods inventory. |

|

|

|

| 20 |  |

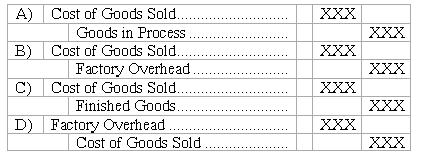

A proper journal entry to close overapplied overhead to Cost of Goods Sold would be:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802454/q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802454/q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|

|

| 21 |  |

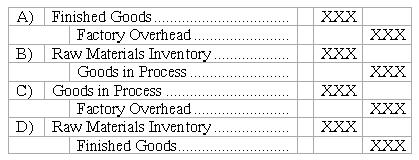

A proper journal entry to record issuing raw materials to be used on a job would be:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802454/q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802454/q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a> |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|

|

| 22 |  |

The balance in the Goods in Process account equals: |

|  | A) | the balance in the Finished Goods inventory account. |

|  | B) | the balance in the Cost of Goods Sold account. |

|  | C) | the balances on the job cost sheets of uncompleted jobs. |

|  | D) | the balance in the Factory Overhead account. |

|

|

|

| 23 |  |

In a job order cost system, the use of indirect materials previously purchased is recorded as a decrease in: |

|  | A) | Raw Materials inventory. |

|  | B) | Goods in Process inventory. |

|  | C) | Factory Overhead. |

|  | D) | Finished Goods inventory. |

|

|

|

| 24 |  |

In a job order cost system using predetermined manufacturing overhead rates, indirect materials issued into production usually are recorded as an increase in: |

|  | A) | Goods in Process inventory. |

|  | B) | Finished Goods inventory. |

|  | C) | Raw Materials inventory. |

|  | D) | Factory Overhead. |

|

|

|

| 25 |  |

There are two acceptable methods for closing out any balance of under- or overapplied overhead. One method involves allocation, whereas the other closes any balance directly to: |

|  | A) | Finished Goods inventory. |

|  | B) | Cost of Goods Sold. |

|  | C) | Cost of Goods Manufactured. |

|  | D) | Goods in Process inventory. |

|

|

|

| 26 |  |

Manufacturing overhead can be applied using |

|  | A) | direct labor hours |

|  | B) | machine hours |

|  | C) | as a percentage of total direct labor costs |

|  | D) | all of the above |

|  | E) | none of these |

|

|

|

| 27 |  |

When raw materials are purchased during the period under a job order costing system, the journal entry includes. |

|  | A) | debit Raw Materials Inventory. |

|  | B) | debit Cash. |

|  | C) | debit Accounts Payable |

|  | D) | credit Raw Materials Inventory. |

|  | E) | None of these is true. |

|

|

|

| 28 |  |

When materials are needed in production, a production manager prepares a materials requisition and sends it to the materials manager. The journal entry to record the transfer of raw materials to production would include: |

|  | A) | a credit to goods in process inventory and a debit to raw materials inventory. |

|  | B) | a debit to goods in process inventory and a credit to finished goods inventory. |

|  | C) | a debit to goods in process inventory and a credit to raw materials inventory. |

|  | D) | a debit to raw materials inventory and a credit to finished goods inventory. |

|  | E) | none of these. |

|

|

|

| 29 |  |

In a job order cost system, the application of direct labor to a job is recorded as a DECREASE in: |

|  | A) | Raw Materials inventory. |

|  | B) | Goods in Process inventory. |

|  | C) | Factory Overhead. |

|  | D) | Factory Payroll. |

|

|

|

| 30 |  |

A proper journal entry to record the application of factory overhead to a job would be:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802454/q15.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802454/q15.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|