|

| 1 |  |

Indirect expenses generally are not subject to the control of the department manager. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

A cost center incurs costs without directly generating revenues. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

The salary of a supervisor who manages more than one department, may be allocated to departments on the basis of the number of employees in each department. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

The salary of an employee who works in only one department is a direct expense of that one department. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

When a department that has a positive departmental contribution margin is eliminated, the net income of the firm as a whole is reduced by the amount of the departmental margin. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

A cost is controllable if a manager has the power to determine or at least significantly affect the amount incurred. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

In an Income Statement showing departmental contribution to overhead, direct expenses for each department are shown separately under each department. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

Indirect expenses are expenses incurred for the benefit of particular departments. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

Rent expense for a building is reasonably allocated to a department on the basis of floor space it occupies. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

Service departments make a product. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

A profit center incurs costs without directly generating revenues. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

A responsibility accounting system is set up to control costs and expenses and evaluate managers' performances by assigning costs and expenses to the managers responsible for controlling them. |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

Departmental contribution to overhead is the amount by which a department's expenses exceed its direct overhead. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

An investment center's return on total assets is computed by taking the center's net income and dividing it by the center's average total assets. |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

An income statement showing departmental contribution to overhead subtracts indirect expenses from each department's revenues. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

Which of the following bases is most appropriate for the allocation of rent expense on a building? |

|  | A) | total general expense |

|  | B) | floor space |

|  | C) | number of direct labor hours |

|  | D) | total operating expenses |

|  | E) | none of these |

|

|

|

| 17 |  |

ABC Co is considering eliminating Department B. Department B's gross profit on sales is $50,000. If Department B is discontinued, it is estimated that $35,000 of the $105,000 expenses allocated to it could be eliminated. If Department B is discontinued, the company's income before taxes would |

|  | A) | decrease by $35,000. |

|  | B) | decrease by $15,000. |

|  | C) | increase by $85,000. |

|  | D) | decrease by $50,000. |

|  | E) | do none of these. |

|

|

|

| 18 |  |

When direct departmental expenses are subtracted from gross profit, the result is called |

|  | A) | net income. |

|  | B) | departmental margin. |

|  | C) | indirect expenses. |

|  | D) | net income from operations. |

|  | E) | none of these. |

|

|

|

| 19 |  |

Dentz Company is considering eliminating Department B. Department B's gross profit on sales is $70,000. If Department B is discontinued, it is estimated that $60,000 of the $95,000 expenses allocated to it could be eliminated. If Department B is discontinued, the company's income before taxes would |

|  | A) | decrease by $35,000. |

|  | B) | decrease by $25,000. |

|  | C) | increase by $85,000. |

|  | D) | decrease by $10,000. |

|  | E) | do none of these. |

|

|

|

| 20 |  |

Which of the following expenses incurred by a department is (are) indirect expense(s)? |

|  | A) | depreciation expense on the building |

|  | B) | insurance expense on building |

|  | C) | janitorial services expense |

|  | D) | all of these |

|  | E) | none of these |

|

|

|

| 21 |  |

Which of the following expenses incurred by a department is (are) direct expense(s)? |

|  | A) | sales salaries |

|  | B) | insurance expense on building |

|  | C) | rent expense on a building |

|  | D) | all of these |

|  | E) | none of these |

|

|

|

| 22 |  |

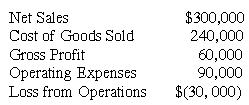

Department B figures taken from a departmentalized work sheet are as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802458/q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802458/q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

Assume that the operating expenses of Department B include $55,000 of direct expenses. Also assume that closing Department B would not affect the sales or the direct expenses of other departments. What is the amount of the departmental margin of Department B? |

|  | A) | $5,000 |

|  | B) | $9,000 |

|  | C) | $(30,000) |

|  | D) | $(5,000) |

|  | E) | none of these |

|

|

|

| 23 |  |

Which of the following bases is most appropriate for the allocation of heating expense? |

|  | A) | total salaries |

|  | B) | floor space occupied |

|  | C) | volume of sales |

|  | D) | cost of equipment |

|  | E) | none of these |

|

|

|

| 24 |  |

A profit center |

|  | A) | does not generate any revenues |

|  | B) | serves other departments |

|  | C) | incurs costs only |

|  | D) | incurs costs and generates revenues |

|  | E) | none of these |

|

|

|

| 25 |  |

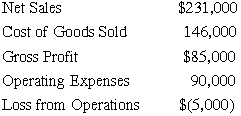

Department B figures taken from a departmentalized work sheet are as follows:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802458/q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802458/q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

Assume that the operating expenses of Department B include $76,000 of direct expenses. Also assume that closing Department B would not affect the sales or the direct expenses of other departments. What is the amount of the departmental margin of Department B? |

|  | A) | $5,000 |

|  | B) | $9,000 |

|  | C) | $10,000 |

|  | D) | $80,000 |

|  | E) | none of these |

|

|

|

| 26 |  |

A responsibility accounting system controls costs and expenses and evaluates managers' performances by |

|  | A) | assigning budgets by managers' seniority |

|  | B) | ranking managers by the profit they generate |

|  | C) | assigning costs and expenses to the managers responsible for controlling them |

|  | D) | assigning responsibility by managers' percentage of total expenses controlled |

|  | E) | none of these |

|

|

|

| 27 |  |

Profit center managers are judged on |

|  | A) | their abilities to generate costs in excess of their department's revenues |

|  | B) | their abilities to generate costs |

|  | C) | their abilities to generate revenues in excess of their department's costs. |

|  | D) | their abilities to service other departments profitably |

|  | E) | maximizing sales revenues. |

|

|

|

| 28 |  |

Utilities expenses such as heating and lighting are usually allocated on the basis of |

|  | A) | each department's proportion of total sales |

|  | B) | number of employees in each department |

|  | C) | number of hours that a department uses equipment and machinery. |

|  | D) | floor space a department occupies |

|  | E) | dollar amounts of purchases or number of purchase orders processed. |

|

|

|

| 29 |  |

If a center with an average investment of $2 million yields a net income of $150,000, its return on total assets is |

|  | A) | 30% |

|  | B) | 7.5% |

|  | C) | 13.33%. |

|  | D) | 15% |

|  | E) | none of these. |

|

|

|

| 30 |  |

A retailer has three departments-A, B and C. It buys janitorial services that benefit all departments. Janitorial service expense is $50,000 for the year, and floor space for the departments follow: A=5,000 ft; B=2,000 ft; C=4,000 ft. How much janitorial expense is allocated to department A if allocation is based on floor space? |

|  | A) | $41,667 |

|  | B) | $9,091 |

|  | C) | $25,000 |

|  | D) | $22,727 |

|  | E) | none of these |

|

|