|

| 1 |  |

If actual cost of direct labor was $1,700 for 500 units but the standard cost for direct labor for these same units was $2,000, then the direct labor cost variance is an unfavorable $300. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

When sales volume changes, flexible budgets can sometimes prove more useful to managers than fixed budgets. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

A flexible budget is also called a "static" budget. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

A flexible budget performance report lists differences between actual performance and budgeted performance based on actual sales volume or other activity level. |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

Standard costs can be calculated for direct labor and direct materials. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

An unfavorable direct materials price variance would arise because too much material was used during production. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

A direct labor efficiency variance would arise because actual labor hours incurred during production were different than the standard amount that should have been used for that level of production. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

A favorable direct labor rate variance would arise because actual labor cost-per-hour was greater than the standard labor cost per hour. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

If actual cost of materials was $4,000 for 200 units but the standard cost for material for these same units was $3,900, then the material cost variance is a favorable $100. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

The purchasing department is usually responsible for the price paid for materials. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

The overhead cost variance is the difference between the total overhead cost applied to products and the total overhead cost actually incurred. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

Actual Cost (AC) = Actual Quantity (AQ) + Actual Price (AP) |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

An unfavorable direct labor efficiency variance would be explained by the production manager. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

A standard cost is an amount incurred at the actual level of production for the period. |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

The direct labor cost variance is a Favorable $600. If the direct labor efficiency variance is Unfavorable $200, then the direct labor rate variance is a Favorable $800. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

If the activity level increases 10%, total variable costs will? |

|  | A) | remain the same |

|  | B) | increase by more than 10% |

|  | C) | decrease by less than 10% |

|  | D) | increase 10% |

|  | E) | none of these |

|

|

|

| 17 |  |

The relevant range of activity refers to the |

|  | A) | geographical areas where the company plans to operate |

|  | B) | activity level where all costs are constant |

|  | C) | levels of activity over which the company expects to operate |

|  | D) | level of activity where productivity is constant |

|  | E) | none of these |

|

|

|

| 18 |  |

Which of the following is a major LIMITATION of a fixed budget performance report. |

|  | A) | The inability of fixed budget reports to adjust for changes in activity levels |

|  | B) | is based on predicted amounts of revenues and expenses corresponding |

|  | C) | to the actual level of output |

|  | D) | Prepared before the period and is often based on several levels of activity |

|  | E) | None of these |

|

|

|

| 19 |  |

ABC Co. produced 32,000 units in 10,000 direct labor hours. Production for the period was estimated at 33,000 units and 11,000 direct labor hours. A flexible budget would compare budgeted costs and actual costs, respectively, at |

|  | A) | 33,000 units and 32,000 units |

|  | B) | 11,000 hours and 10,000 hours |

|  | C) | 33,000 units and 33,000 units |

|  | D) | 32,000 units and 32,000 units |

|

|

|

| 20 |  |

A price variance arises when |

|  | A) | actual quantity of input used and budgeted quantity of input |

|  | B) | difference between actual price per unit of input and budgeted price per unit of input |

|  | C) | difference between last year's price per unit of input and this year's price per unit of input |

|  | D) | difference between standard materials cost and standard labor cost |

|  | E) | none of these |

|

|

|

| 21 |  |

ABC Co. applies overhead on the basis of $3 per direct labor hour. ABC's direct labor standard is one direct labor hour per unit. If actual production volume was 400 units and actual manufacturing overhead was $1,650. The overhead variance is. |

|  | A) | favorable variance of $450 |

|  | B) | unfavorable variance of $450 |

|  | C) | favorable variance of $1,650 |

|  | D) | unfavorable variance of $1,650 |

|  | E) | none of these |

|

|

|

| 22 |  |

ABC Co. has the following information:

Actual cost . . . . . . . . . . . . 2,500 lbs. @ $1.15 per lb. = $2,875

Standard cost . . . . . . . . . . 2,400 lbs. @ $1.00 per lb. = $2,400

What is the direct materials cost variance? |

|  | A) | favorable variance of $475 |

|  | B) | unfavorable variance of $475 |

|  | C) | favorable variance of $2,400 |

|  | D) | unfavorable variance of $115 |

|  | E) | none of these |

|

|

|

| 23 |  |

ABC Co. has the following information:

Actual cost . . . . . . . . . . . . 2,500 lbs. @ $1.15 per lb. = $2,875

Standard cost . . . . . . . . . . 2,400 lbs. @ $1.00 per lb. = $2,400

What is the direct materials price variance? |

|  | A) | favorable variance of $360 |

|  | B) | unfavorable variance of $360 |

|  | C) | favorable variance of $375 |

|  | D) | unfavorable variance of $375 |

|  | E) | none of these |

|

|

|

| 24 |  |

ABC Co. has the following information:

Actual cost . . . . . . . . . . . . 2,500 lbs. @ $1.15 per lb. = $2,875

Standard cost . . . . . . . . . . 2,400 lbs. @ $1.00 per lb. = $2,400

What is the direct materials quantity variance? |

|  | A) | favorable variance of $100 |

|  | B) | unfavorable variance of $100 |

|  | C) | favorable variance of $115 |

|  | D) | unfavorable variance of $115 |

|  | E) | none of these |

|

|

|

| 25 |  |

ABC Co. has the following information:

Actual cost . . . . . . . . . . . . 200 hrs. @ $8.00 per hr. = $1600

Standard cost . . . . . . . . . . 220 hrs. @ $7.90 per hr. = $1738

What is the direct labor cost variance? |

|  | A) | favorable variance of $20 |

|  | B) | unfavorable variance of $22 |

|  | C) | favorable variance of $138 |

|  | D) | unfavorable variance of $138 |

|  | E) | none of these |

|

|

|

| 26 |  |

ABC Co. has the following information:

Actual cost . . . . . . . . . . . . 200 hrs. @ $8.00 per hr. = $1600

Standard cost . . . . . . . . . . 220 hrs. @ $7.90 per hr. = $1738

What is the direct labor efficiency variance? |

|  | A) | favorable variance of $160 |

|  | B) | unfavorable variance of $20 |

|  | C) | favorable variance of $158 |

|  | D) | unfavorable variance of $158 |

|  | E) | none of these |

|

|

|

| 27 |  |

ABC Co. has the following information:

Actual cost . . . . . . . . . . . . 200 hrs. @ $8.00 per hr. = $1600

Standard cost . . . . . . . . . . 220 hrs. @ $7.90 per hr. = $1738

What is the direct labor rate variance? |

|  | A) | favorable variance of $20 |

|  | B) | unfavorable variance of $158 |

|  | C) | favorable variance of $22 |

|  | D) | unfavorable variance of $22 |

|  | E) | none of these |

|

|

|

| 28 |  |

When budgeted and actual results are not the same amount, there is a budget |

|  | A) | error |

|  | B) | variance |

|  | C) | anomaly |

|  | D) | by-product |

|

|

|

| 29 |  |

A department has budgeted monthly fixed manufacturing overhead cost of $90,000 plus $4 per direct labor hour. If the actual level of activity for the month was 21,000 direct labor hours, what is the total budgeted manufacturing overhead cost for the month using a flexible budget? |

|  | A) | $90,000 |

|  | B) | $84,000 |

|  | C) | $174,000 |

|  | D) | cannot be determined |

|

|

|

| 30 |  |

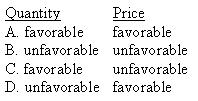

If the purchasing agent buys materials at a price significantly below the standard price, but in doing so acquires materials that are significantly below grade in terms of quality, what direct material price and quantity variances are likely?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802459/q15.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802459/q15.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|