|

| 1 |  |

Fixed costs are constant in total but vary (decline) per unit as more units are produced. |

|  | A) | True |

|  | B) | False |

|

|

|

| 2 |  |

Sunk costs are always relevant in decision making. |

|  | A) | True |

|  | B) | False |

|

|

|

| 3 |  |

Differential costs are the additional costs incurred if a company pursues a certain course of action. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

Sales -Variable costs = Net income |

|  | A) | True |

|  | B) | False |

|

|

|

| 5 |  |

A company sells a product for $60 per unit with variable costs of $36 per unit. The contribution margin ratio is 60%. |

|  | A) | True |

|  | B) | False |

|

|

|

| 6 |  |

The direct labor cost of a product is one example of a fixed cost. |

|  | A) | True |

|  | B) | False |

|

|

|

| 7 |  |

A cost can be classified as fixed, mixed or variable. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

If a company has fixed costs of $1,000 and a per-unit contribution margin of $40. It must sell 40,000 units to break even. |

|  | A) | True |

|  | B) | False |

|

|

|

| 9 |  |

The excess of expected sales over the breakeven sales level is called a company's margin of safety. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

An opportunity cost is the potential benefit lost by taking a specific action when two or more alternative choices are available. |

|  | A) | True |

|  | B) | False |

|

|

|

| 11 |  |

A company has fixed costs of $8,000 and a per-unit contribution margin of $50 and it wants to make $400 of pre-tax income. It must sell 168 units to break even. |

|  | A) | True |

|  | B) | False |

|

|

|

| 12 |  |

If total sales revenue is $40,000, total variable costs are $5,000 and fixed costs are $25,000, the contribution margin is $10,000. |

|  | A) | True |

|  | B) | False |

|

|

|

| 13 |  |

The decision to make or buy a component for a current product is common and depends on incremental costs. |

|  | A) | True |

|  | B) | False |

|

|

|

| 14 |  |

A company sells a product for $50 per unit with variable costs of $6 per unit. The contribution margin ratio is 12%? |

|  | A) | True |

|  | B) | False |

|

|

|

| 15 |  |

A business segment is a candidate for elimination if its revenues are less than its avoidable expenses. |

|  | A) | True |

|  | B) | False |

|

|

|

| 16 |  |

Which of the following is not a type of relevant costs |

|  | A) | opportunity costs. |

|  | B) | out-of-pocket costs. |

|  | C) | sunk costs. |

|  | D) | all of the above are relevant costs. |

|

|

|

| 17 |  |

Opportunity costs are: |

|  | A) | not used for decision making. |

|  | B) | the same as variable costs. |

|  | C) | the same as historical costs. |

|  | D) | relevant to decision making. |

|

|

|

| 18 |  |

The opportunity cost of making a component part in a factory with NO EXCESS CAPACITY is the: |

|  | A) | variable manufacturing cost of the component. |

|  | B) | fixed manufacturing cost of the component. |

|  | C) | total manufacturing cost of the component. |

|  | D) | net benefit foregone from the best alternative use of the capacity required. |

|

|

|

| 19 |  |

Freestone Company is considering renting Machine Y to replace Machine X. It is expected that Y will waste less direct materials than does X. If Y is rented, X will be sold on the open market. For this decision, which of the following factors is (are) relevant?

I Cost of direct materials used

II Resale value of Machine X |

|  | A) | Only I |

|  | B) | Only II |

|  | C) | Both I and II |

|  | D) | Neither I nor II |

|

|

|

| 20 |  |

Which of the following are valid reasons for eliminating a product line?

I. The product line's contribution margin is negative.

II. The product line's traceable fixed costs plus its allocated common corporate costs are less than its contribution margin. |

|  | A) | Only I |

|  | B) | Only II |

|  | C) | Both I and II |

|  | D) | Neither I nor II |

|

|

|

| 21 |  |

When there is a production constraint, a company should emphasize the products with: |

|  | A) | the highest unit contribution margins. |

|  | B) | the highest contribution margin ratios. |

|  | C) | the highest contribution margin per unit of the constrained resource. |

|  | D) | the highest contribution margins and contribution margin ratios. |

|

|

|

| 22 |  |

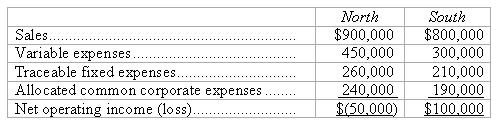

The Kelsh Company has two divisions--North and South. The divisions have the following revenues and expenses:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802460/q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802460/q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

Management at Kelsh is pondering the elimination of North Division. If North Division were eliminated, its traceable fixed expenses could be avoided. The total common corporate expenses would be unaffected. Given these data, the elimination of North Division would result in an overall company net operating income of: |

|  | A) | $100,000. |

|  | B) | $150,000. |

|  | C) | $140,000. |

|  | D) | $50,000. |

|

|

|

| 23 |  |

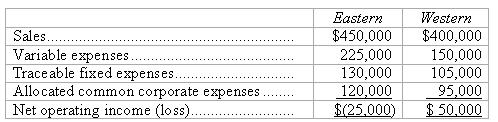

The Kelso Company has two divisions--Eastern and Western. The divisions have the following revenues and expenses:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802460/q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078136679/802460/q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

Management of Kelso is considering the elimination of the Eastern Division. If the Eastern Division were eliminated, then its traceable fixed expenses could be avoided. The total common corporate expenses would be unaffected. Given these data, the elimination of the Eastern Division would result in an overall company net operating income (loss) of: |

|  | A) | $50,000. |

|  | B) | $70,000. |

|  | C) | $25,000. |

|  | D) | $75,000. |

|

|

|

| 24 |  |

Manor Company plans to discontinue a department that has a contribution margin of $24,000 and $48,000 in fixed costs. Of the fixed costs, $21,000 cannot be eliminated. The effect of this discontinuance on Manor's net operating income would be a(an): |

|  | A) | decrease of $3,000. |

|  | B) | increase of $3,000. |

|  | C) | decrease of $24,000. |

|  | D) | increase of $24,000. |

|

|

|

| 25 |  |

ABC Co. sells radios for $20 per unit and incurs variable costs of $8 per unit sold. Its fixed costs are $14,000 per month with monthly capacity of 4,800 units (radios). What is the radio's contribution margin per unit? |

|  | A) | $8 per unit |

|  | B) | $20 per unit |

|  | C) | $12 per unit. |

|  | D) | none of these. |

|

|

|

| 26 |  |

ABC Co. sells radios for $40 per unit and incurs variable costs of $15 per unit sold. Its fixed costs are $14,000 per month with monthly capacity of 4,800 units (radios). What is ABC Co.'s break even point in units (radios)? |

|  | A) | 934 units |

|  | B) | 560 units |

|  | C) | 400 units. |

|  | D) | 350 units. |

|

|

|

| 27 |  |

A company has fixed costs of $18,000 and a per-unit contribution margin of $25 and it wants to make $14,400 of pre-tax income. How many units must it sell to meet this goal? |

|  | A) | 1,296 units |

|  | B) | 720 units |

|  | C) | 576 units. |

|  | D) | 144 units. |

|

|

|

| 28 |  |

If total sales revenue is $160,000, total variable costs are $35,000 and fixed costs are $40,000, What is the contribution margin on the sales? |

|  | A) | $160,000 |

|  | B) | $125,000 |

|  | C) | $85,000. |

|  | D) | $120,000. |

|

|

|

| 29 |  |

What are the incremental costs of accepting additional business? |

|  | A) | They are costs that are never relevant because they resulted from a past decision and are already incurred regardless of the new business. |

|  | B) | They are costs that remain unchanged in total amount regardless of output levels of accepting the new business. |

|  | C) | They are the new costs of accepting new business |

|  | D) | They are the costs which will not be incurred if an old segment is eliminated when accepting new business. |

|

|

|

| 30 |  |

A company unintentionally produced 7,000 defective computers. The computers cost $192 each to produce. A discount seller offers to purchase the defective computers as they are for $248 each. The production manager reports that the defects can be corrected for $150 each, enabling them to be sold at their regular market price of $399 each. The company should: |

|  | A) | Sell the computers to the discount seller for $248 each. |

|  | B) | Correct the defect and sell them at the regular price. |

|  | C) | Sell 5,000 to the discount seller and repair the rest. |

|  | D) | Sell 4,000 to the discount seller and repair the rest. |

|

|